By now almost everyone has already heard of this new “Vacant Home Tax” and most Toronto homeowners have already received their notice to fill out the declaration form online for their property. If you haven’t heard about the new tax or are a little confused about what it is, who it’s for and what it’s for, then you’ve come to the right place.

Over the last several years, governments have been throwing ideas around on how to cool our real estate market down as well as how to create more supply to the market. Just this year, the Federal Government’s plan to ban Foreign Buyers from purchasing property in Canada takes effect. At the municipal level, the City of Toronto has decided to implement and enforce this new “Vacant Home Tax” which they believe will encourage people with vacant homes to either sell these properties or rent them traditionally to tenants and not through services like AirBnB.

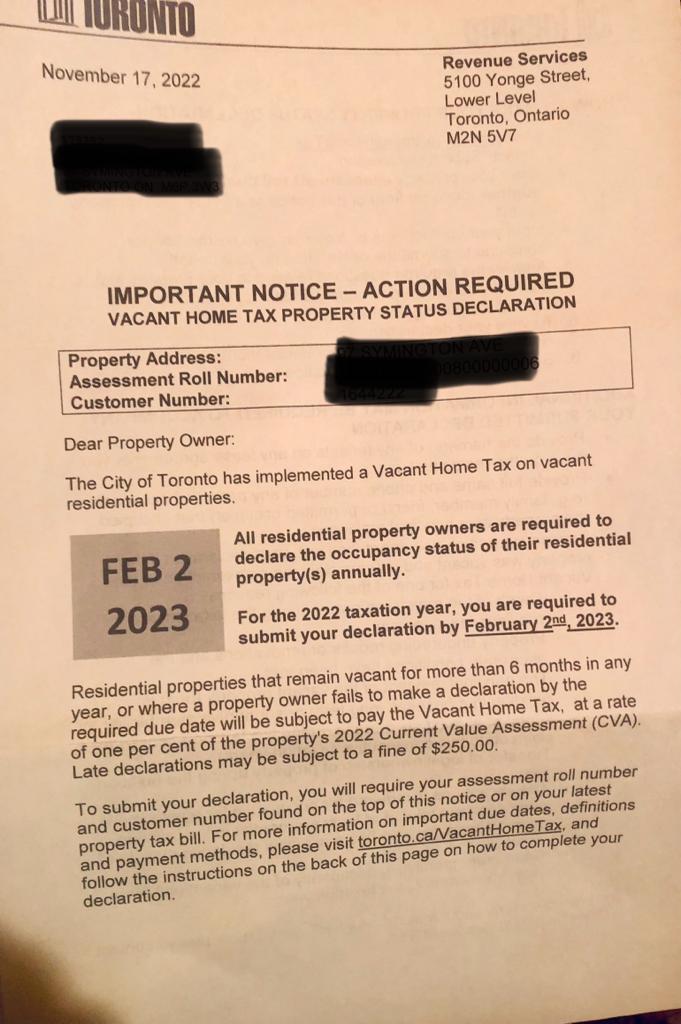

Toronto residents will have until February 2nd, 2023 to fill out their declaration online by visiting the site www.toronto.ca/Vacanthometax while there, you are prompted to input your Assessment Roll Number, your customer Number and then the system will ask a series of questions including whether or not the home has been vacant for a certain number of months and a few more questions. Now, if you do not fill out these declarations by February 2nd, 2023 the city has advised that you will be subject to a fine of $250. Fines for attempting to evade the tax can range from $250 to $10,000.

If you live in your property or have another property which has tenants then you still have to fill out this declaration but you will not be subject to pay this new Vacant Home Tax. If you do own a property that is vacant then you might be subject to this tax which is being calculated to be 1% of your current Value Assessment (the value that MPAC says your home is worth). People subject to the tax will be issued notices in March or April. Payment will be due on May 1.

There are several exemptions to the tax even if your property is vacant for example, death of the registered owner or substantial renovations that are ongoing and a few more that can be found on the city’s site listed above.

At the end of the day, the majority of Toronto Homeowners will not pay any extra tax but it is important to make sure that you fill out this declaration. If you have any questions about this new tax or need help filling out your declaration, please feel free to contact us anytime at the numbers and emails below.

Sources:

https://www.toronto.ca/services-payments/property-taxes-utilities/vacant-home-tax/