We’re back at it again with a review of Market numbers for the month of October. Let’s have a look at the numbers.

We’re back at it again with a review of Market numbers for the month of October. Let’s have a look at the numbers.

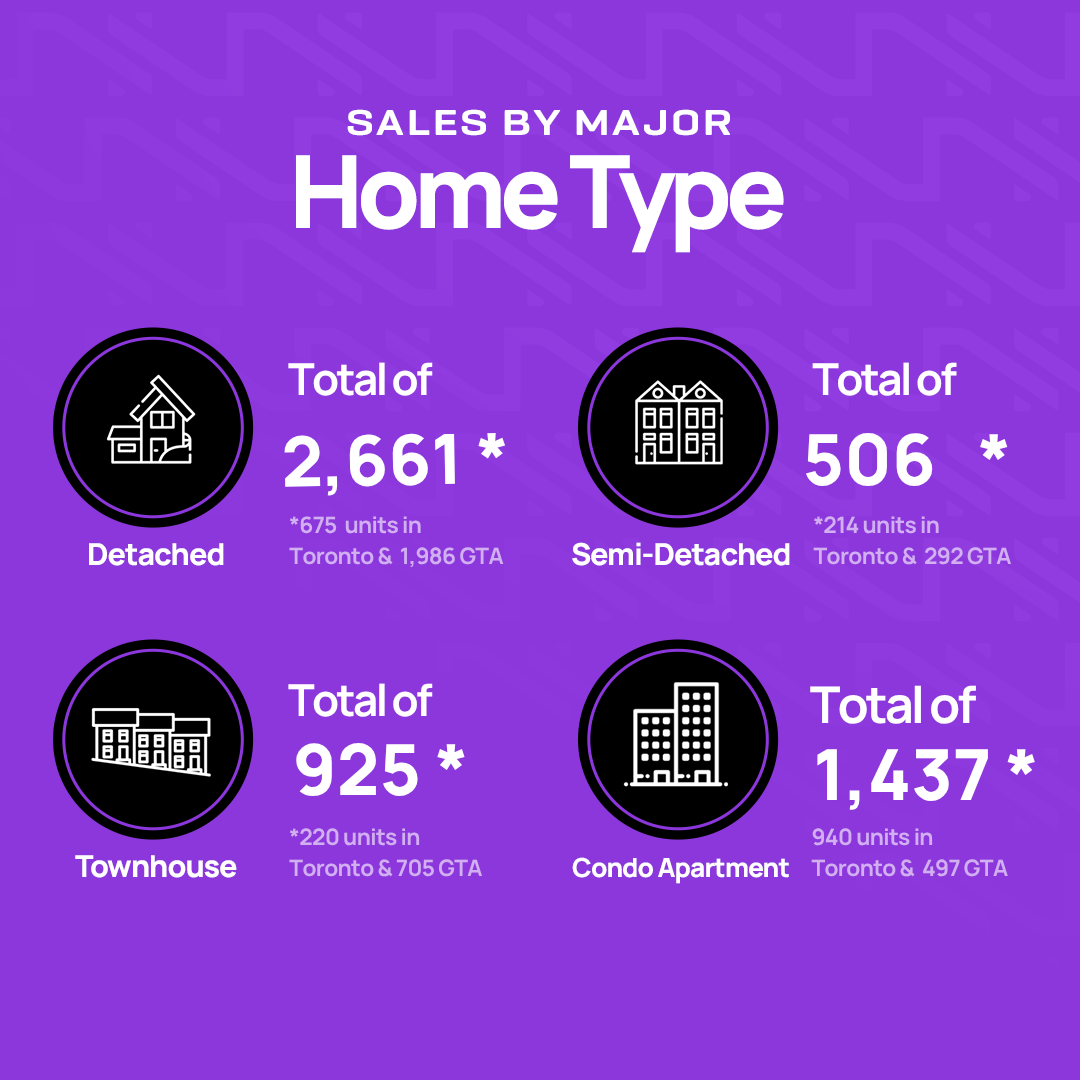

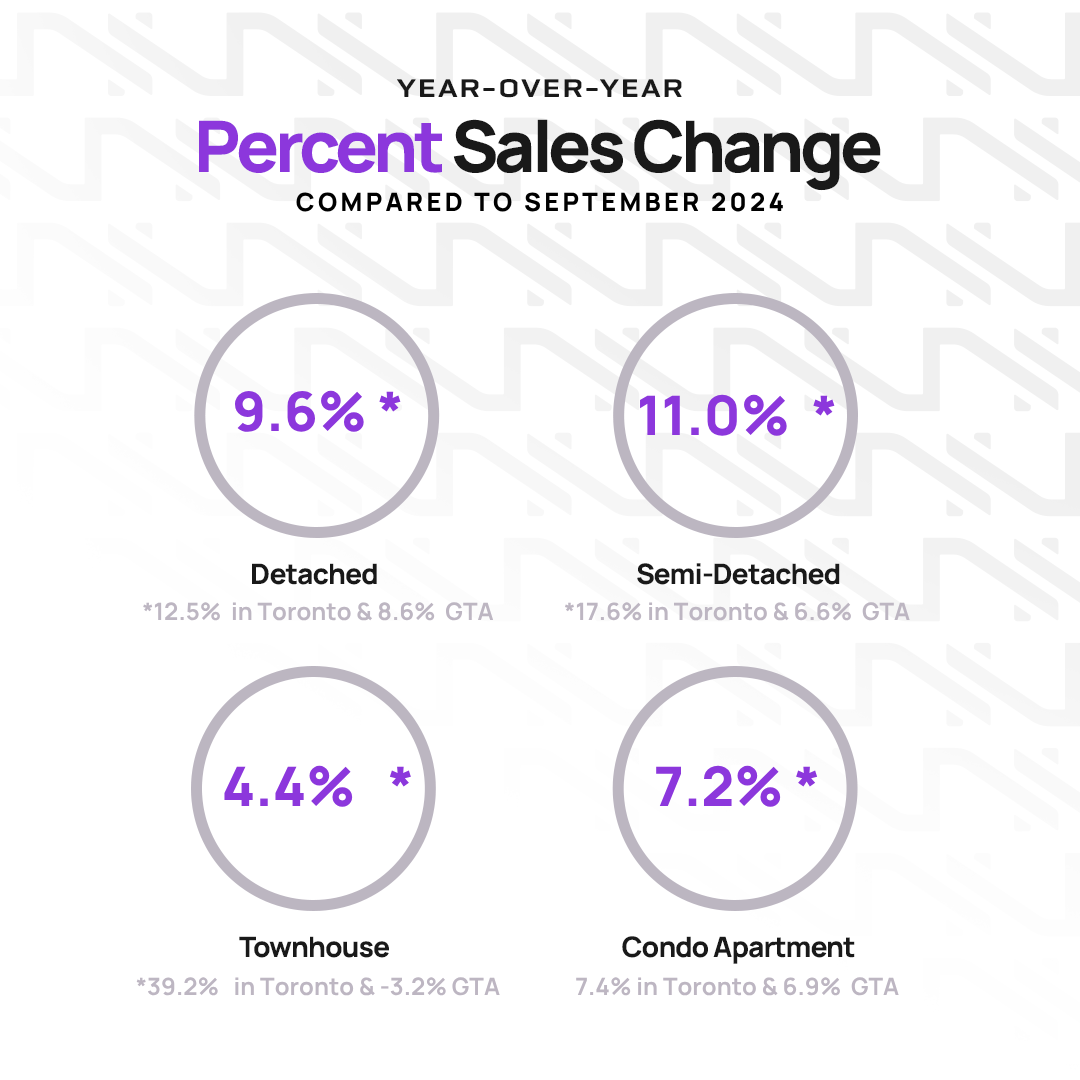

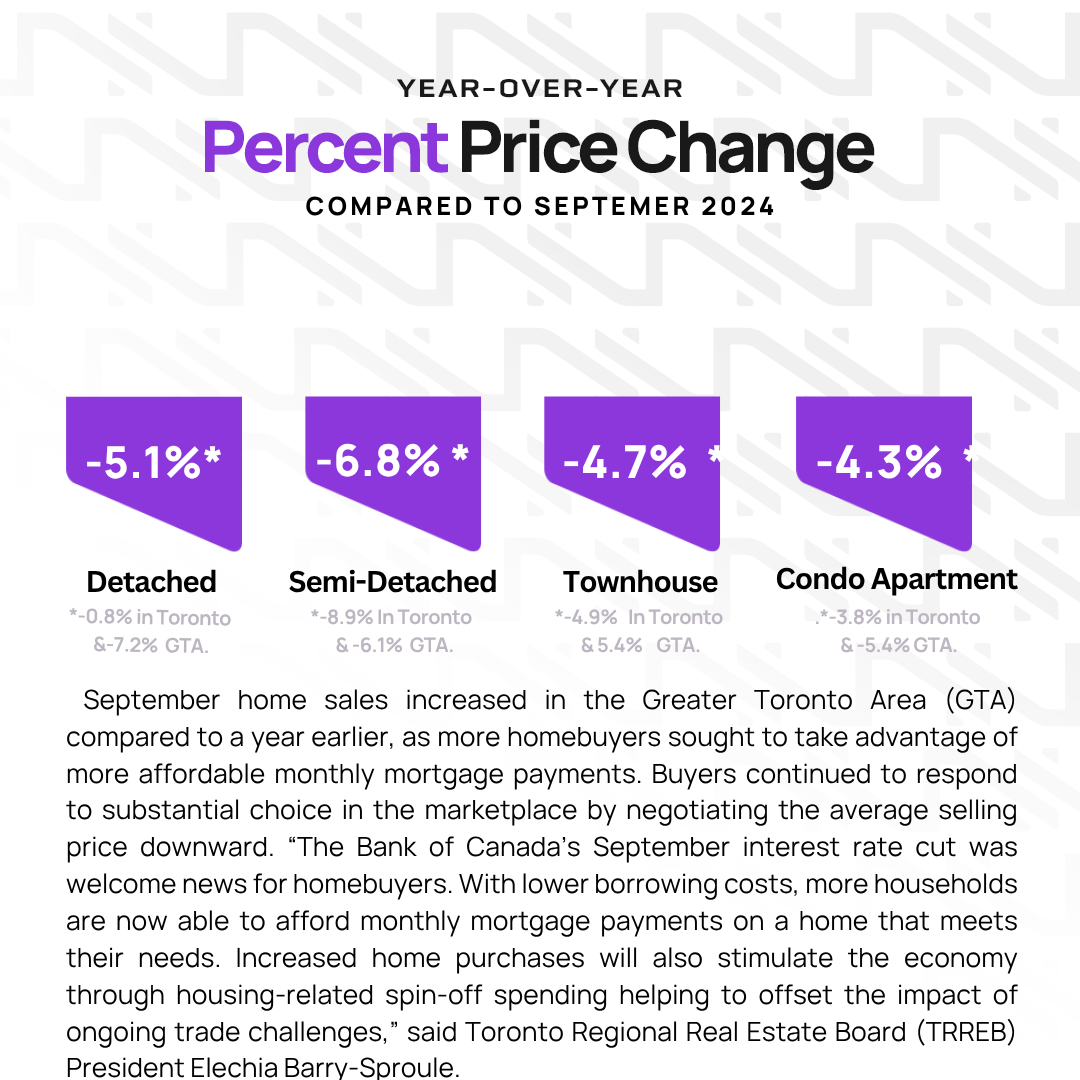

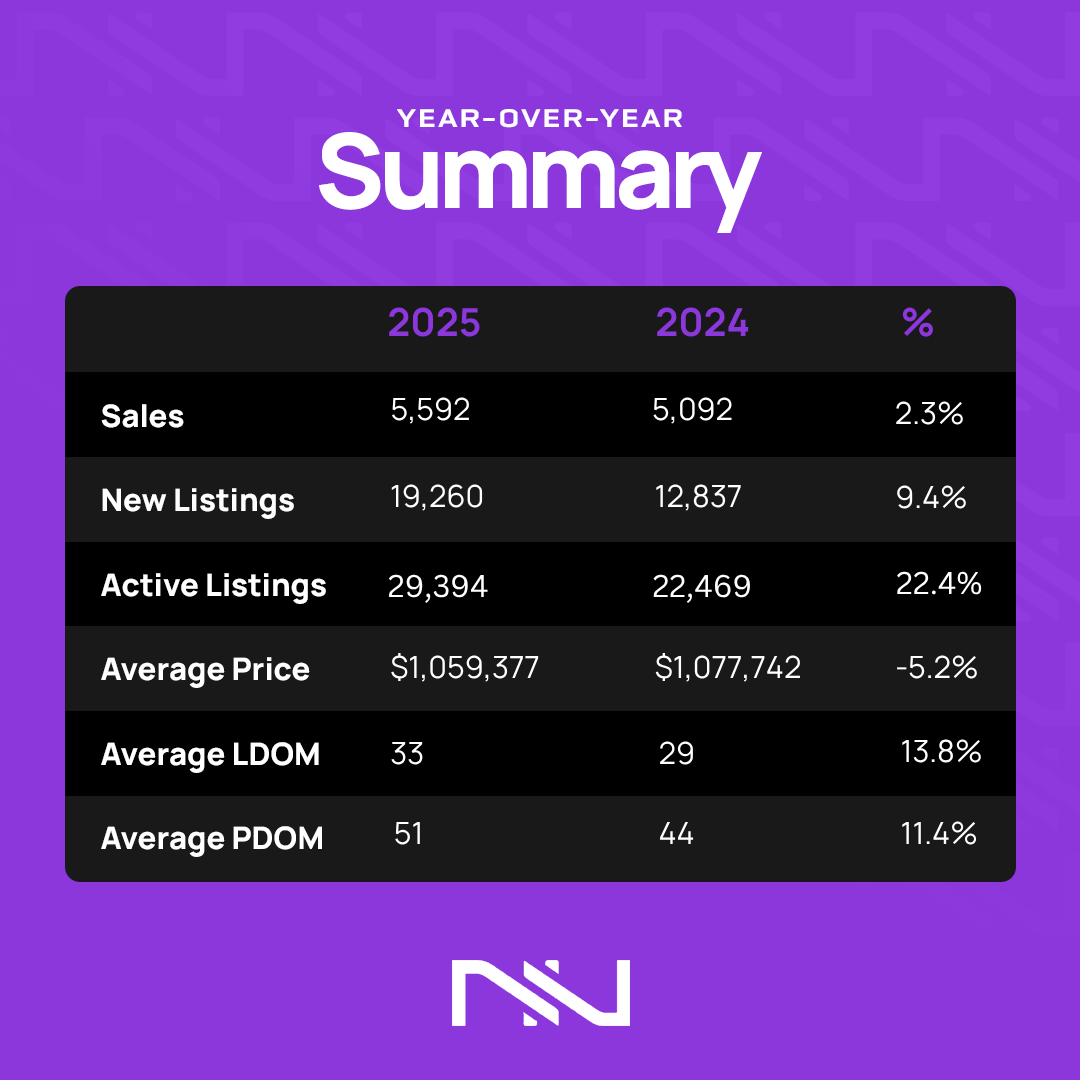

We’re back at it again with a review of Market numbers for the month of September. Let’s have a look at the numbers.

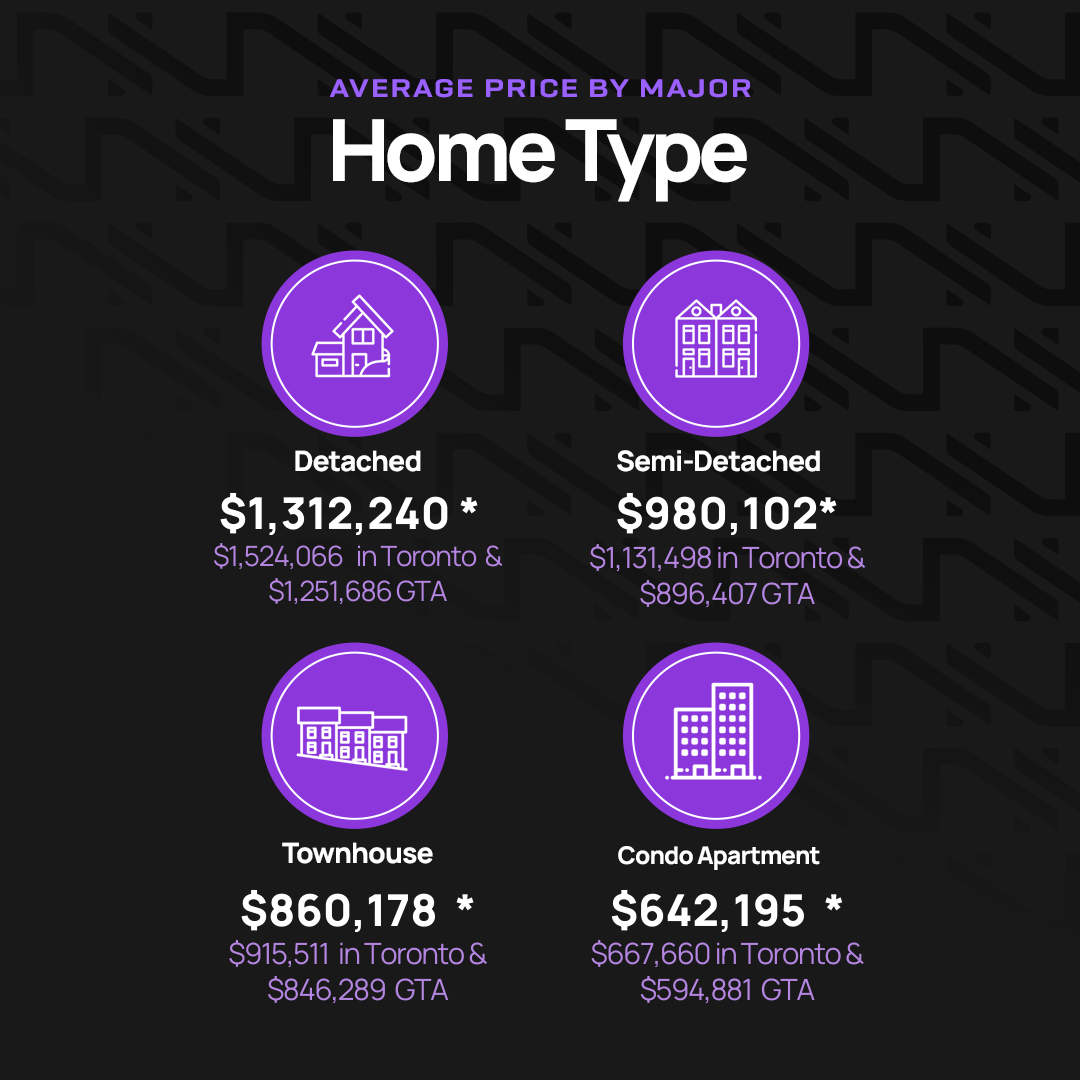

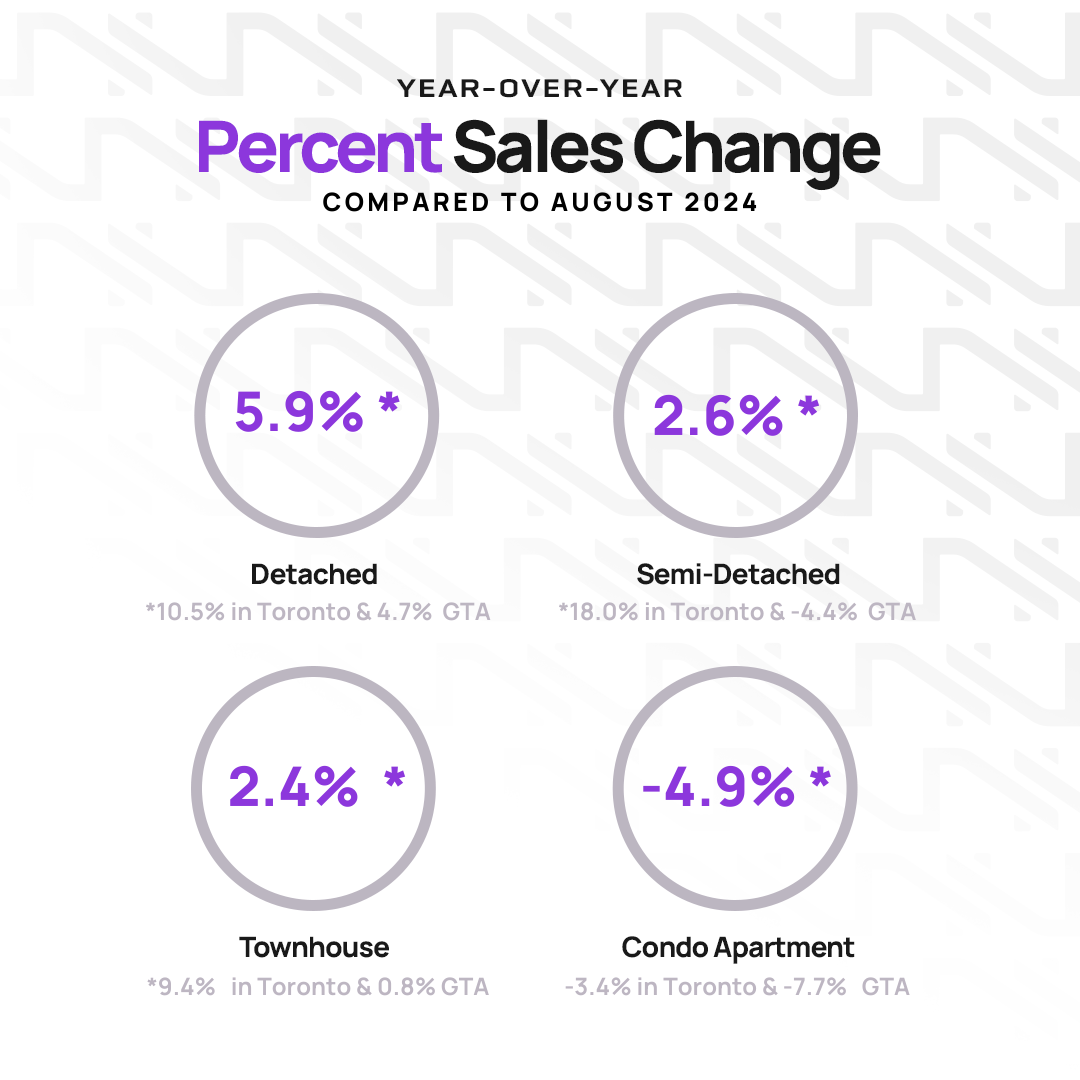

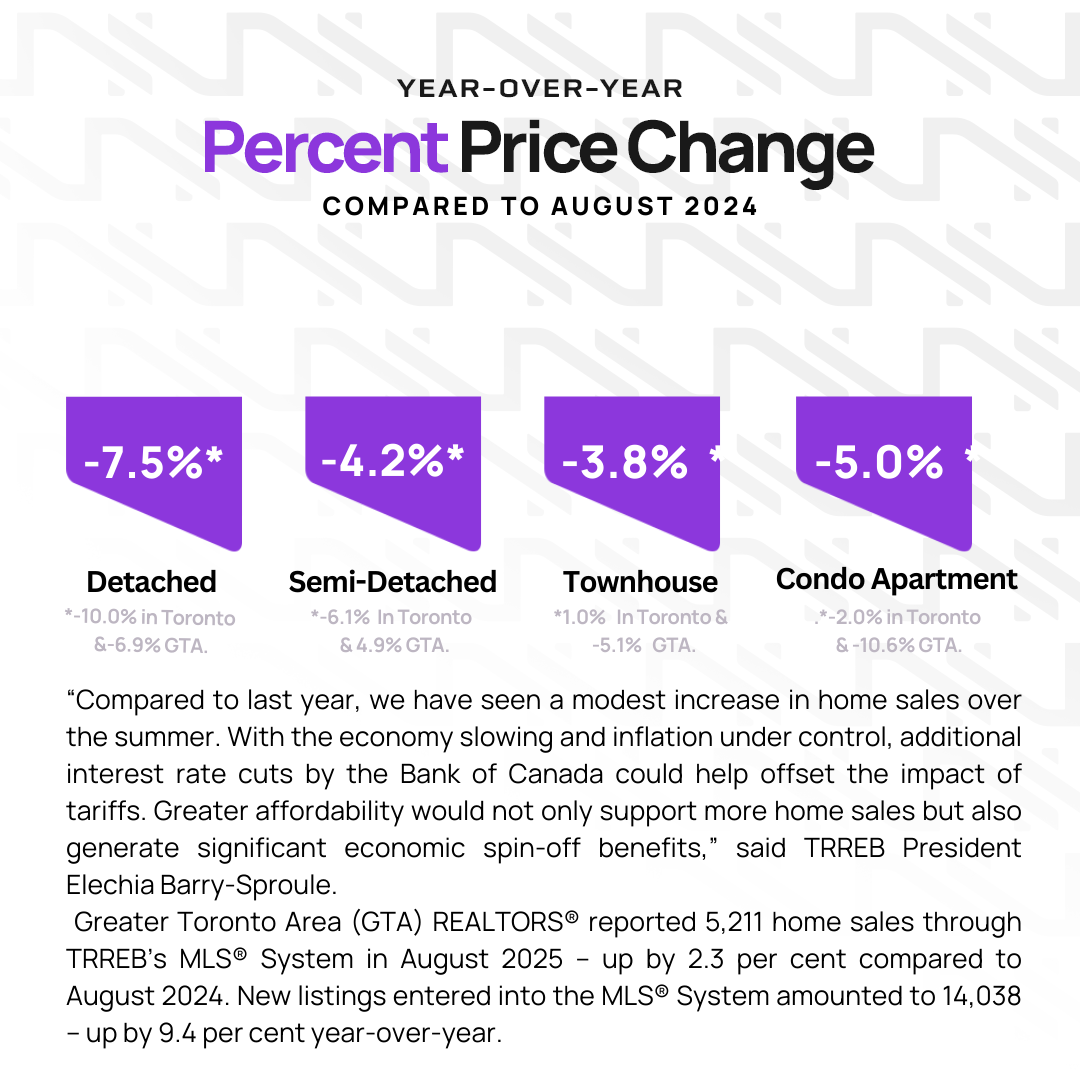

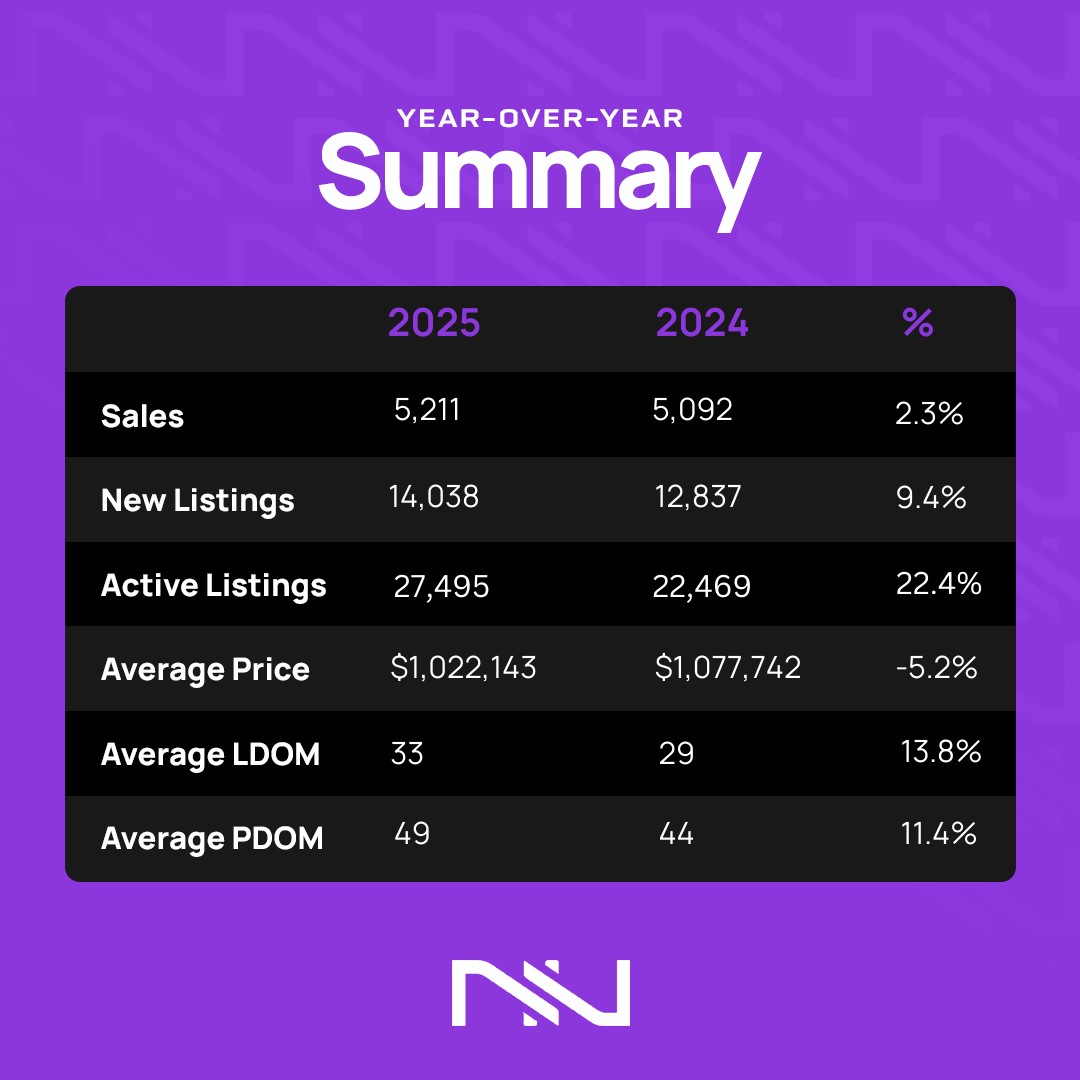

We’re back at it again with a review of Market numbers for the month of August. Let’s have a look at the numbers.

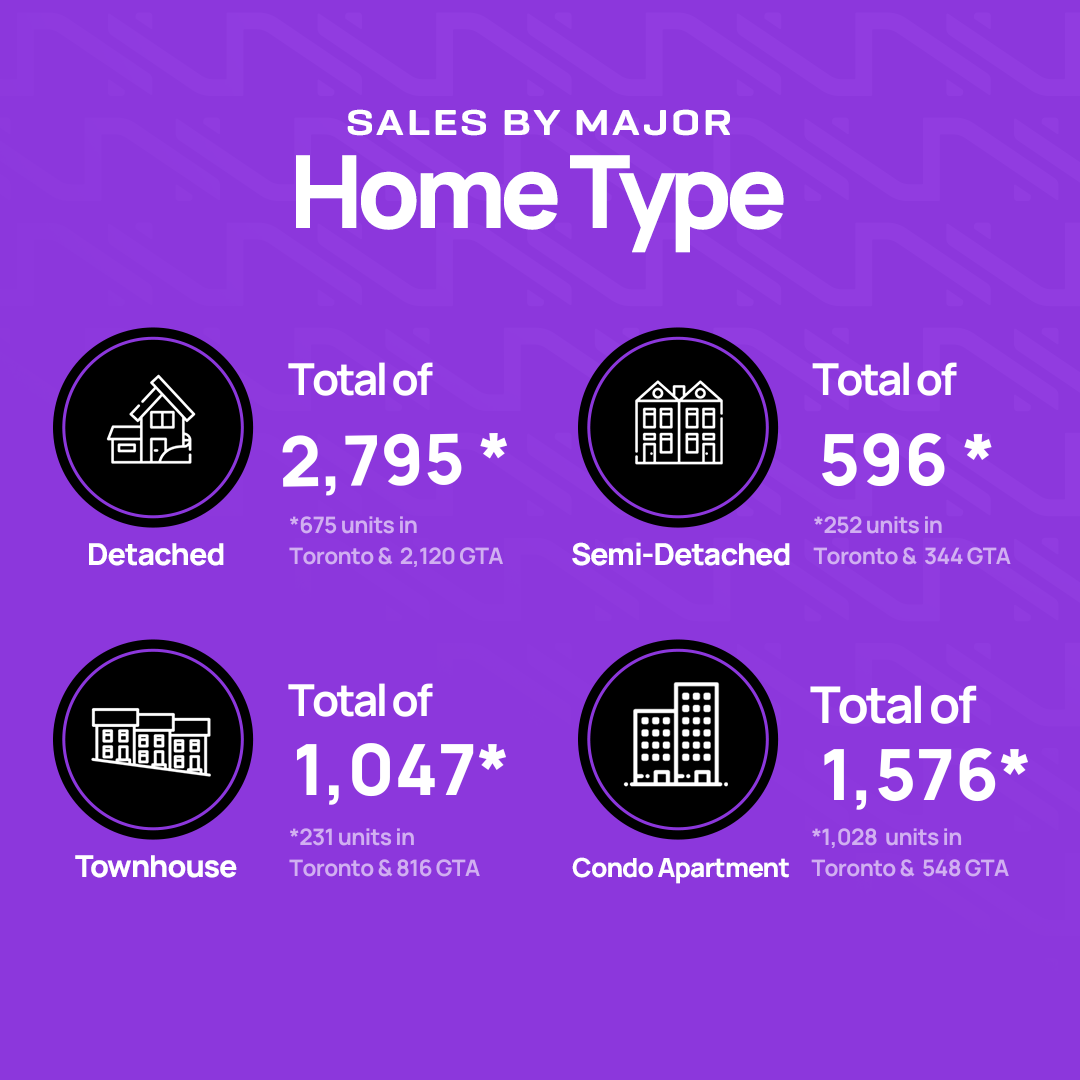

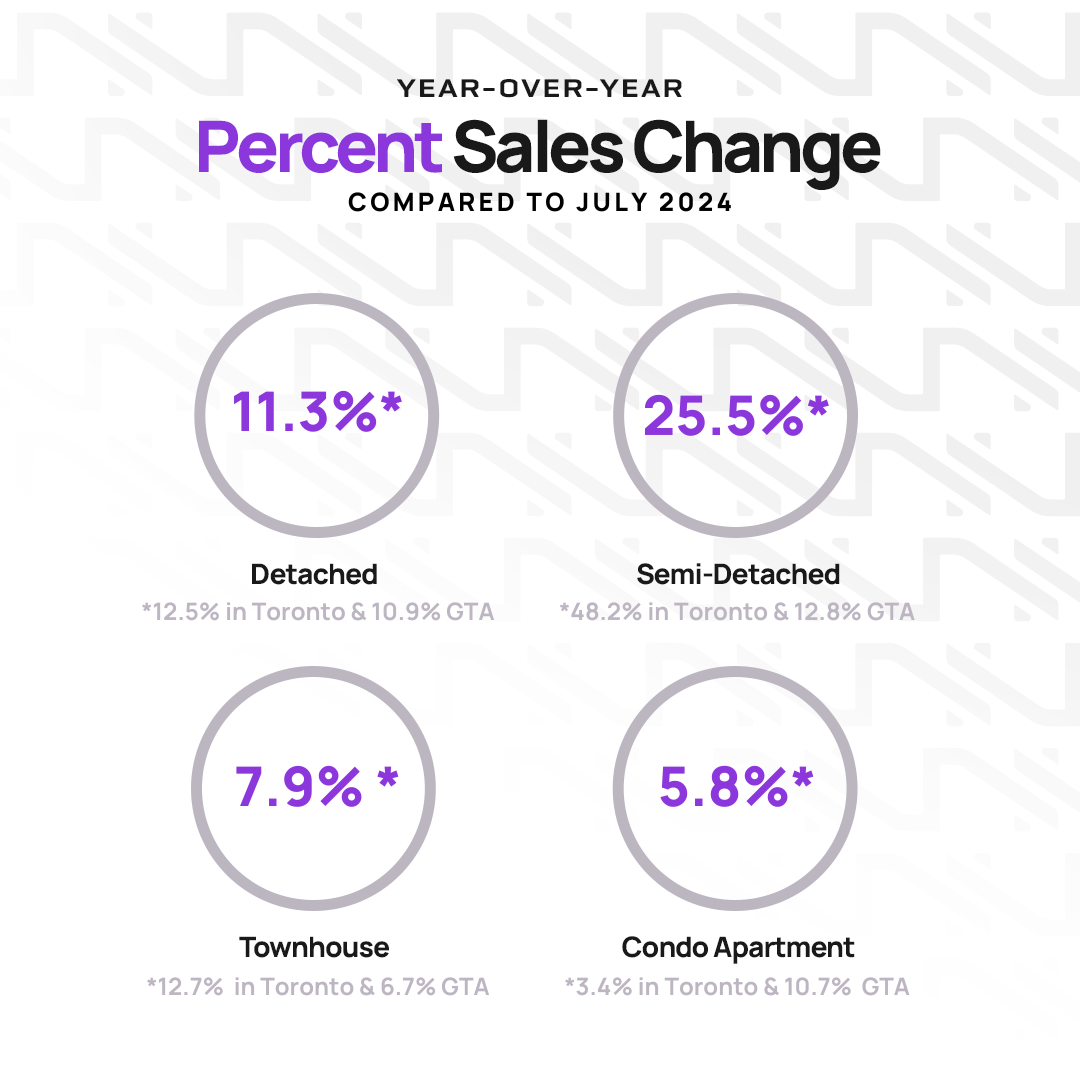

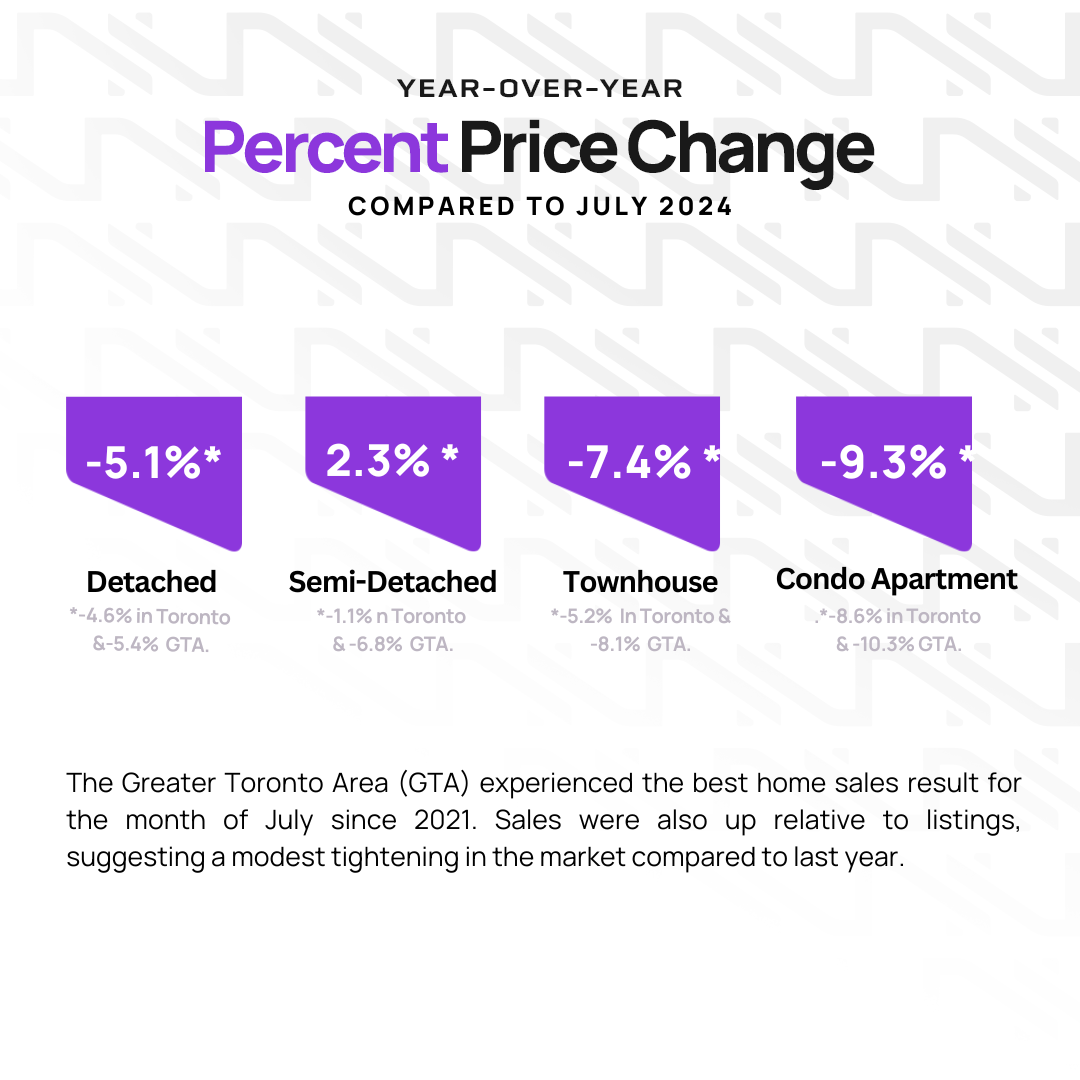

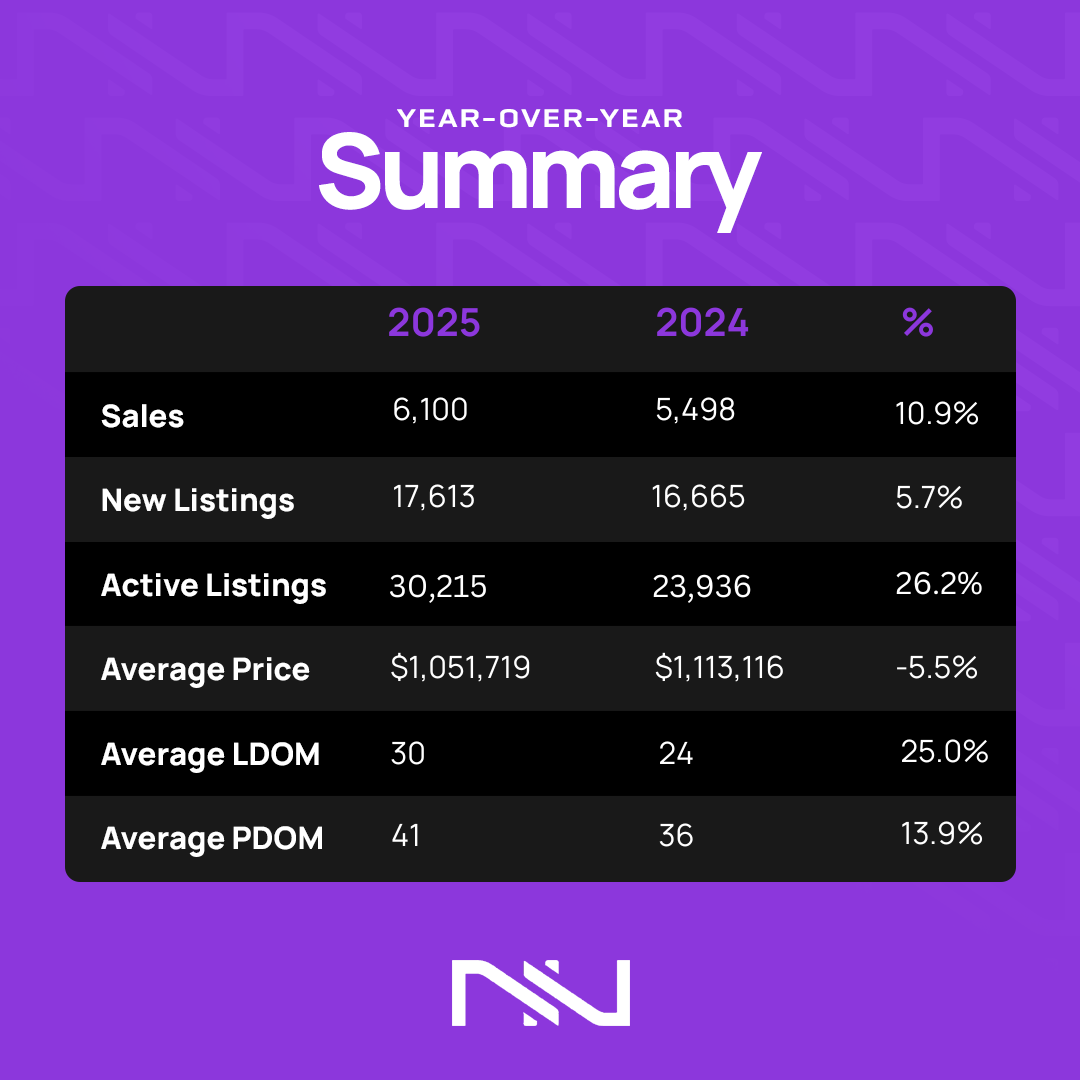

We’re back at it again with a review of Market numbers for the month of July. Let’s have a look at the numbers.

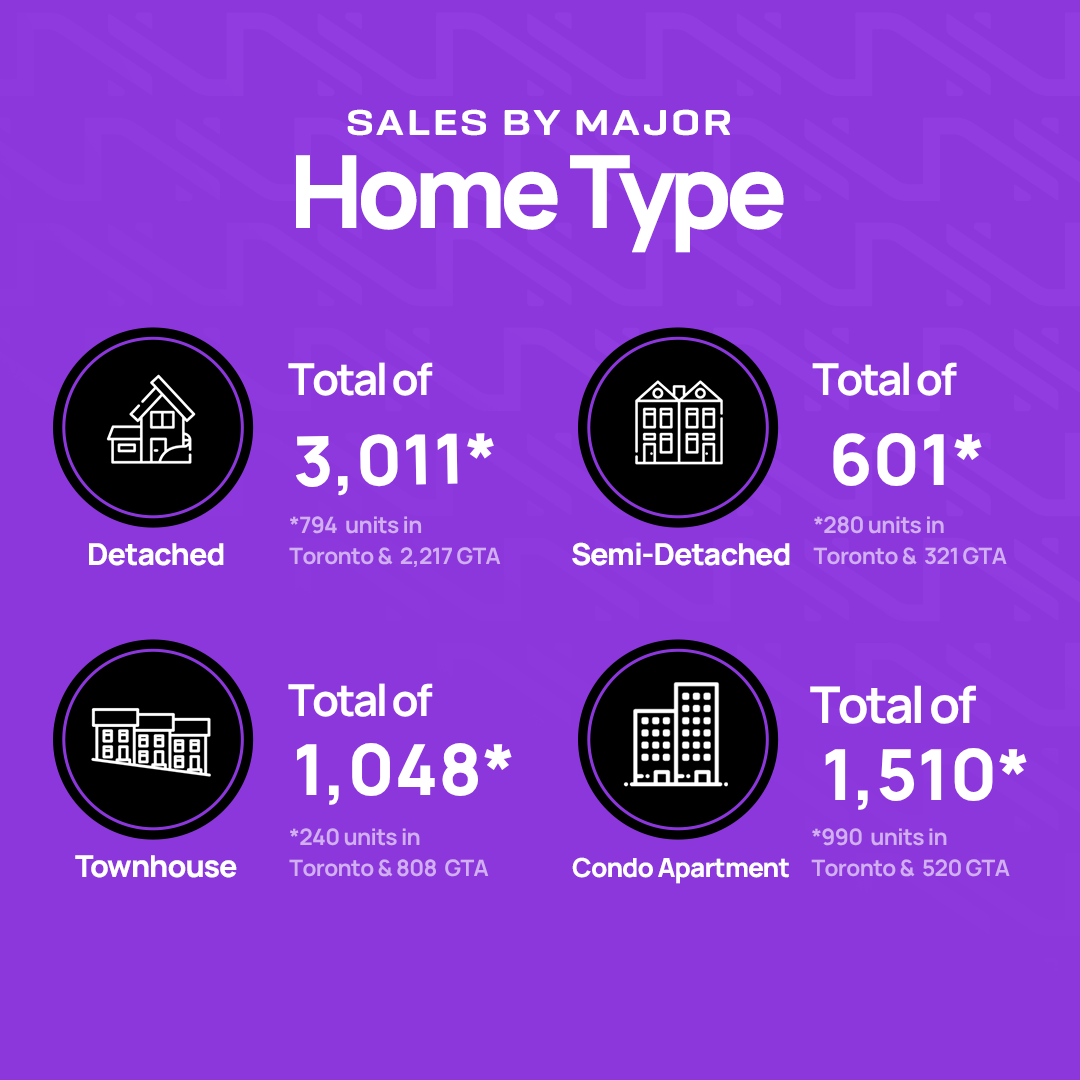

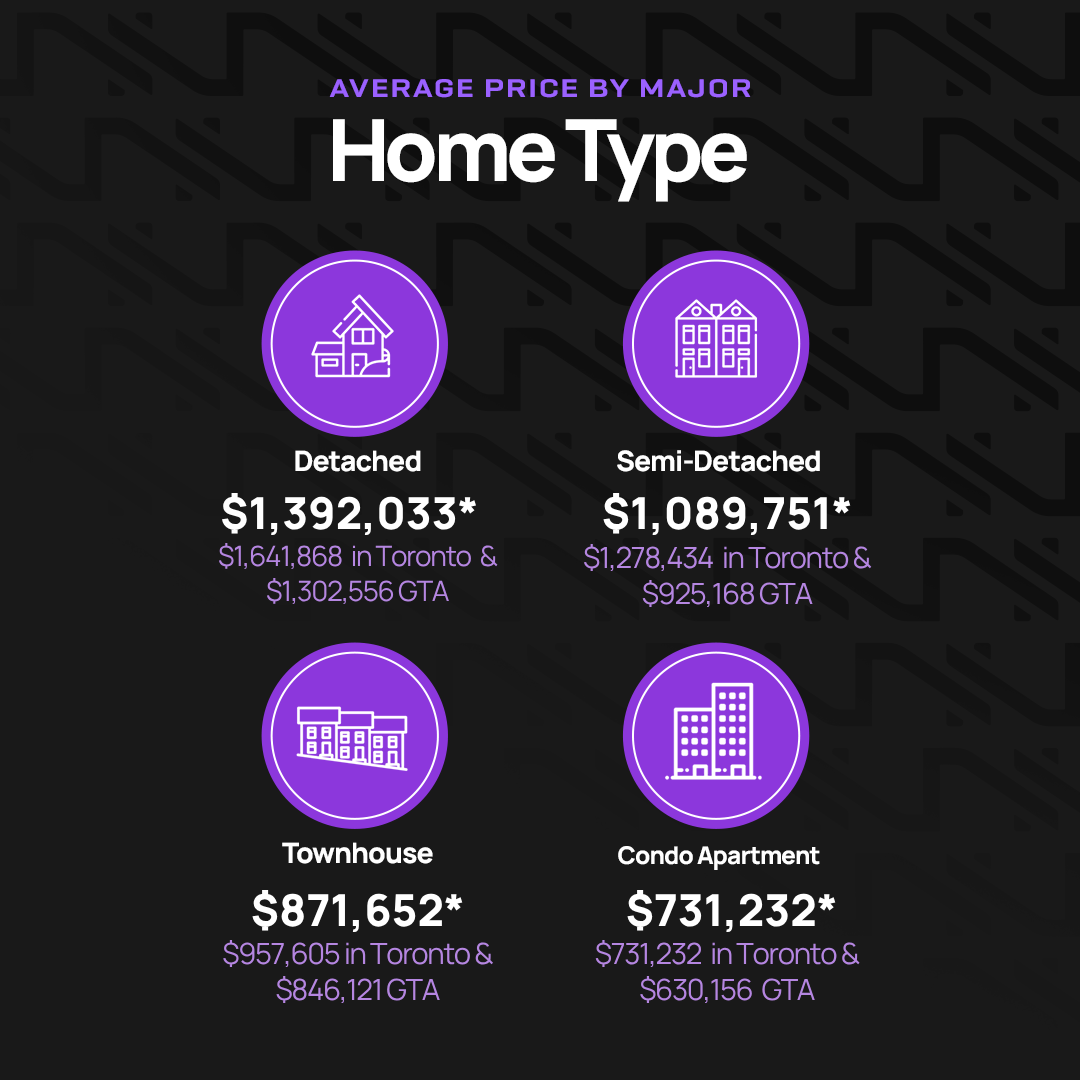

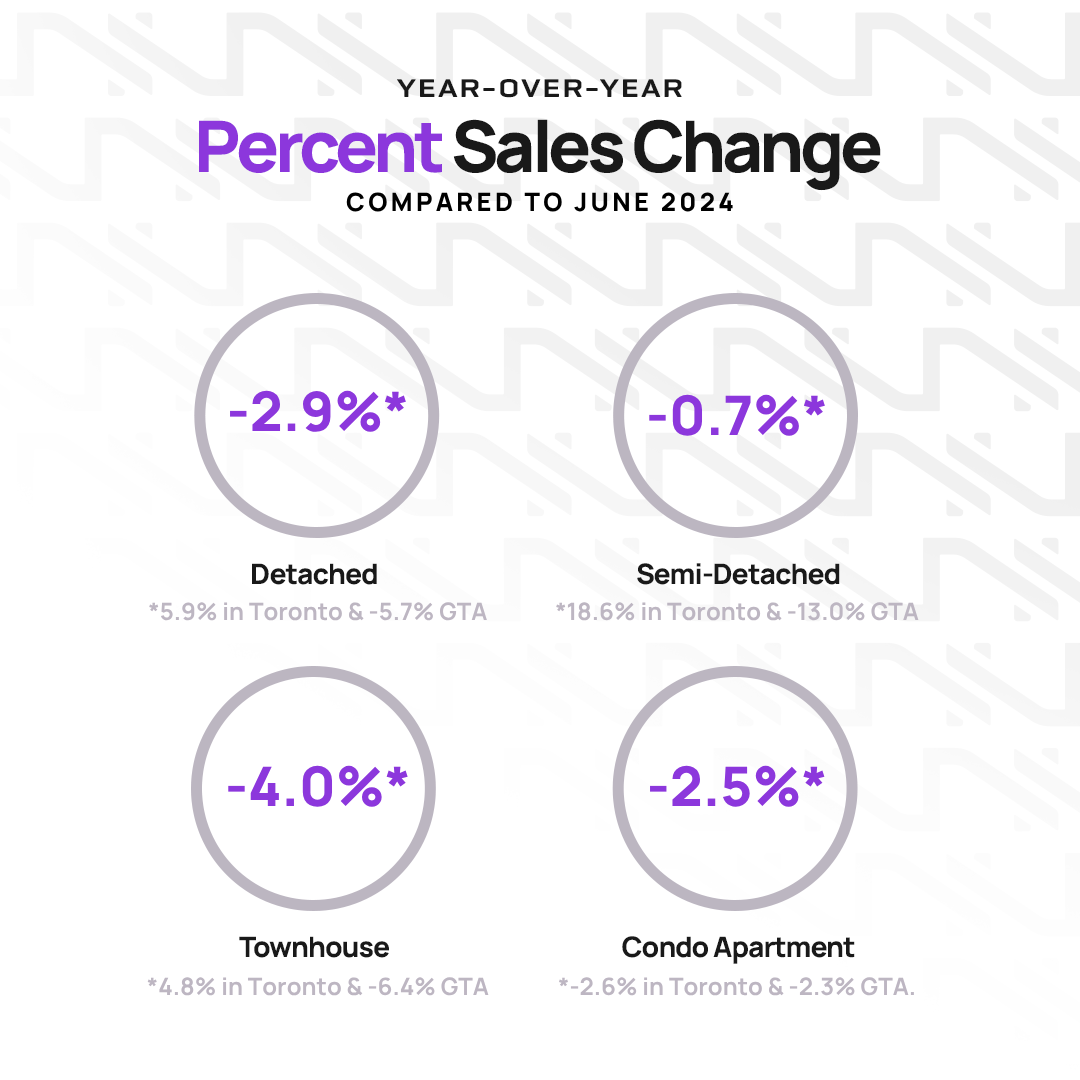

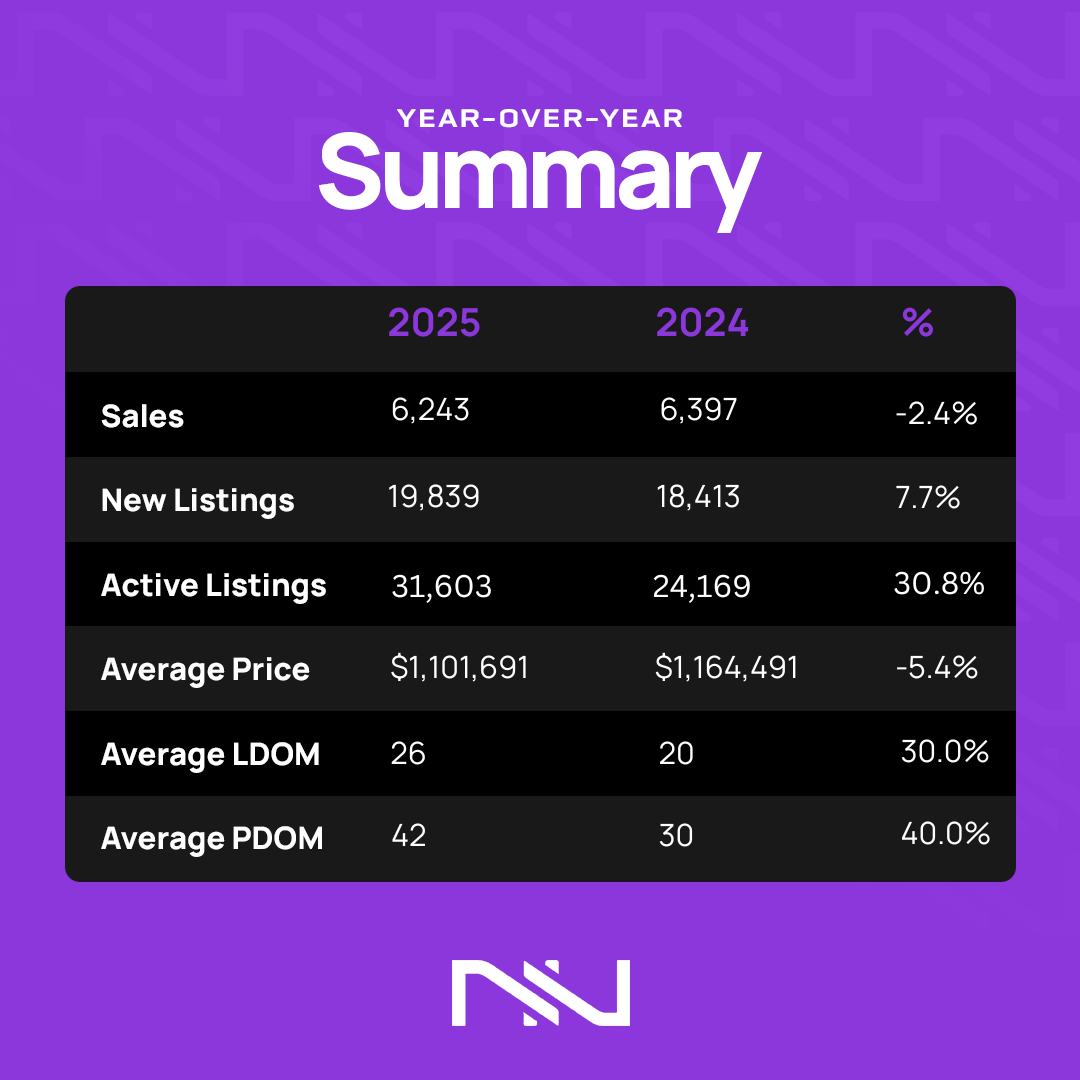

We’re back at it again with a review of Market numbers for the month of June. Let’s have a look at the numbers.

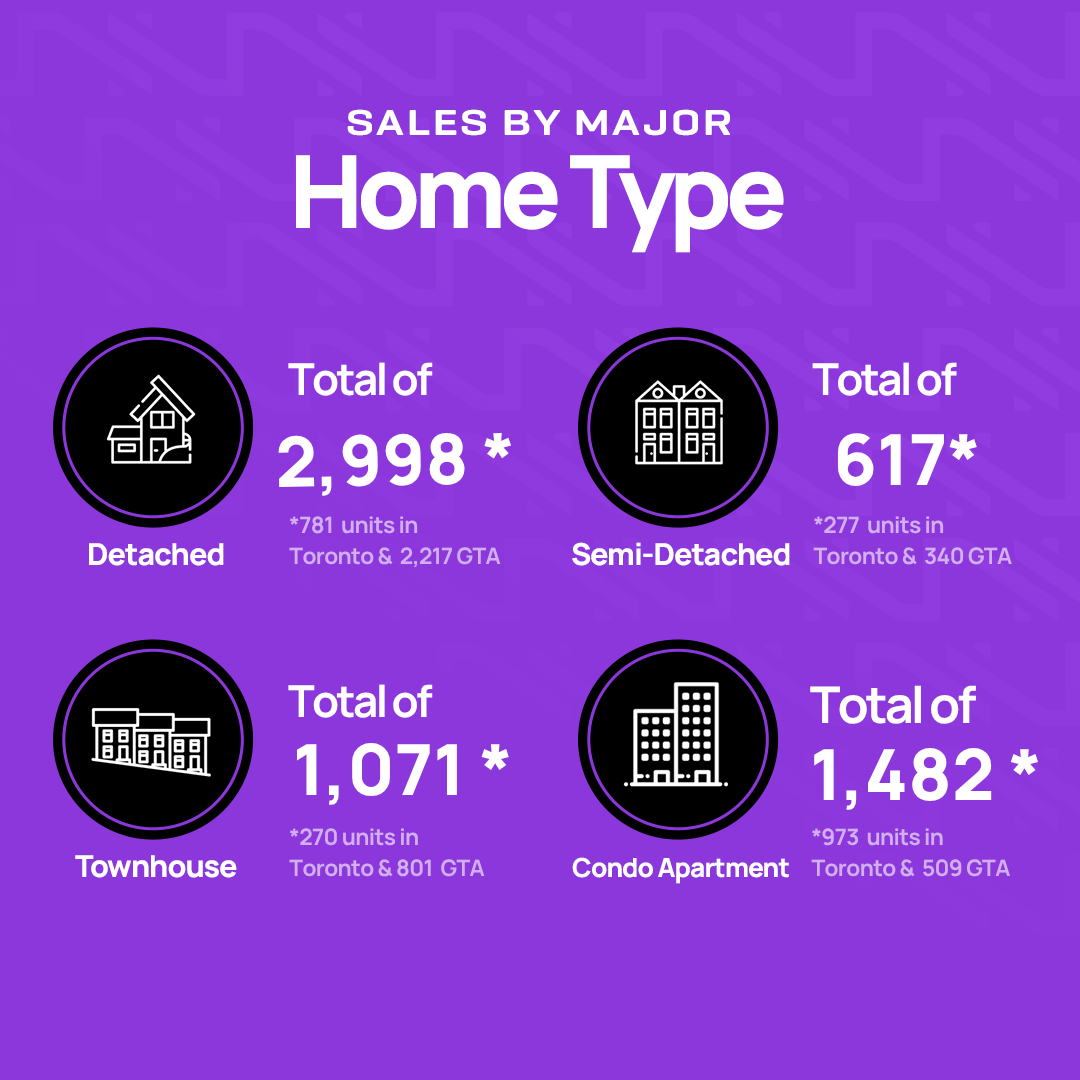

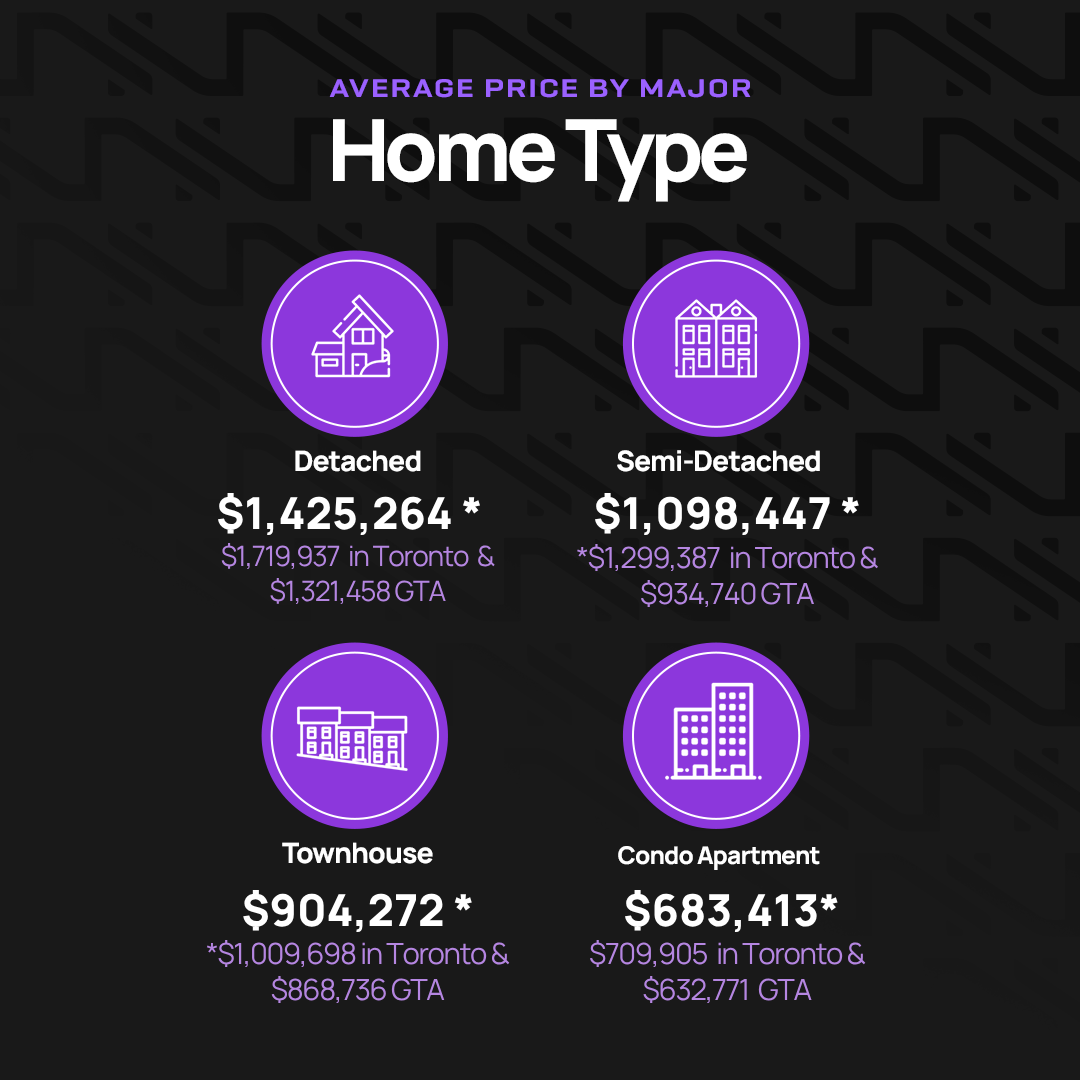

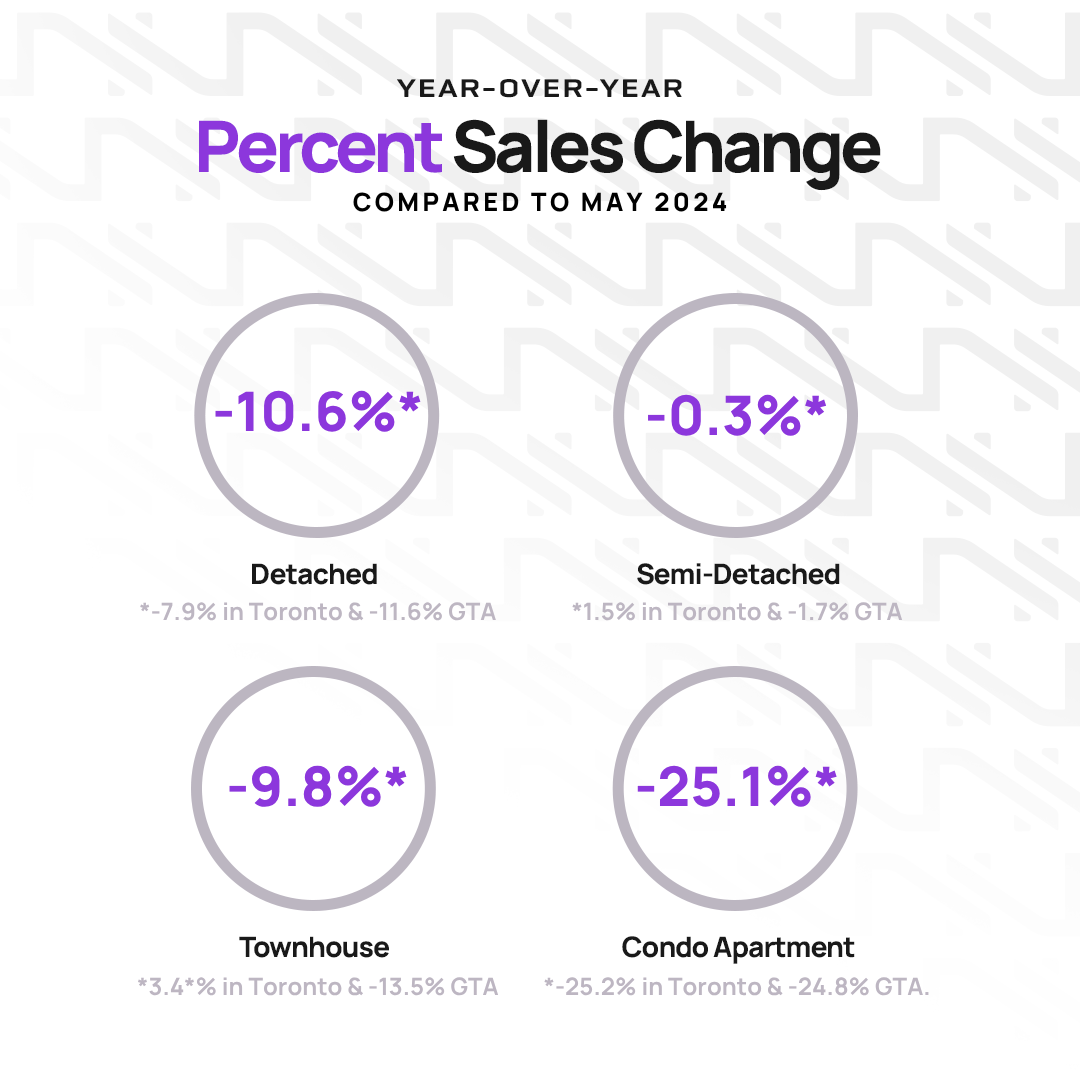

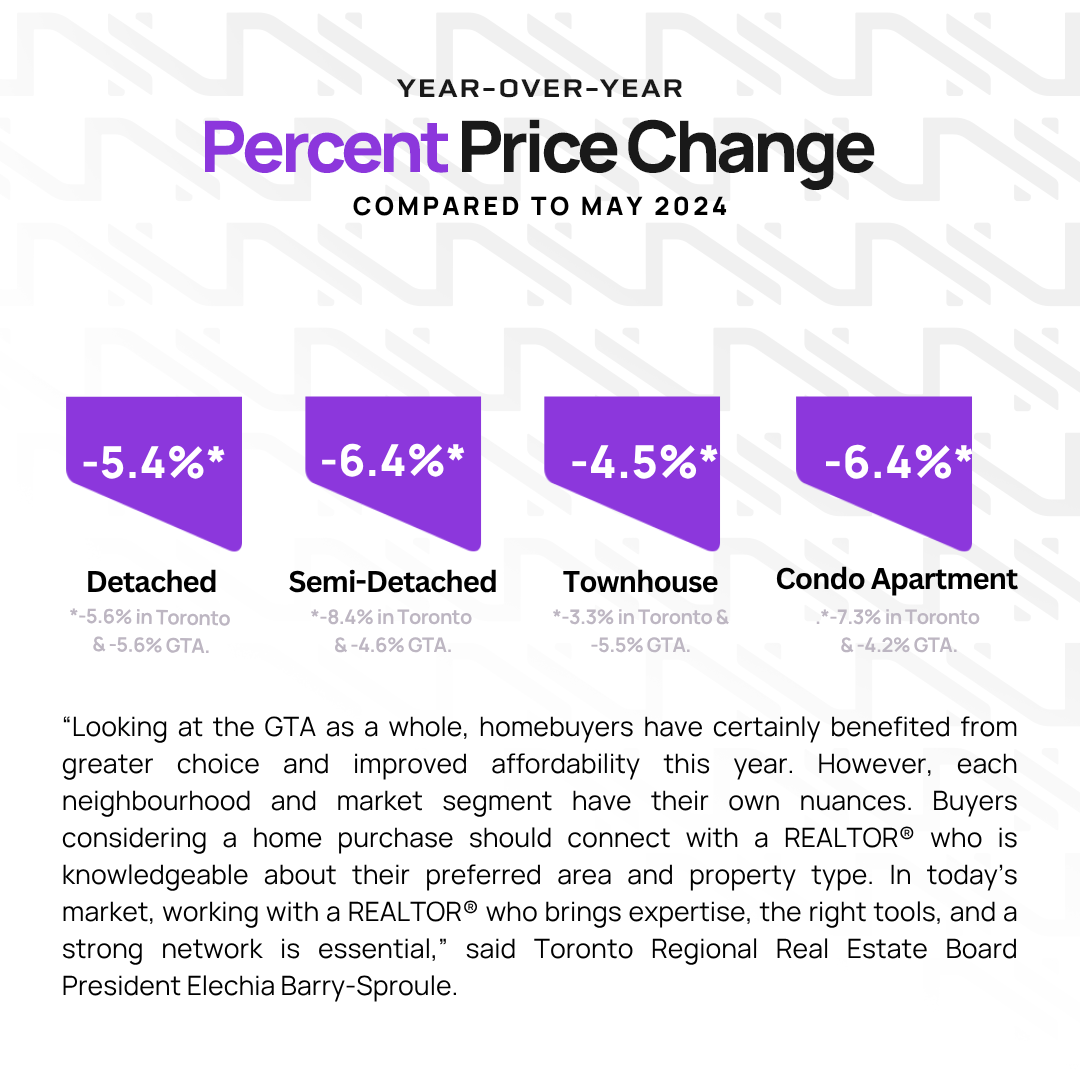

We’re back at it again with a review of Market numbers for the month of May. Let’s have a look at the numbers.

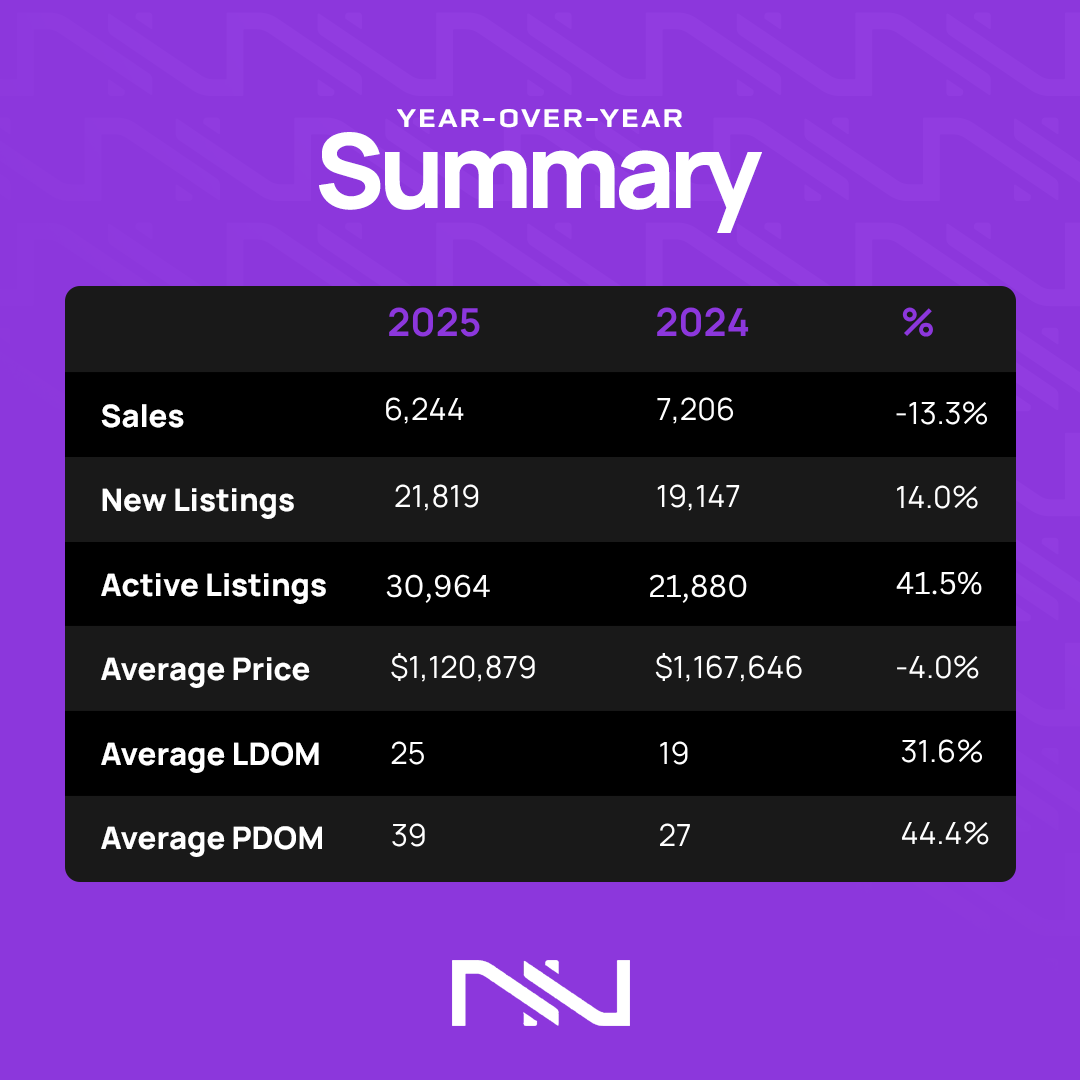

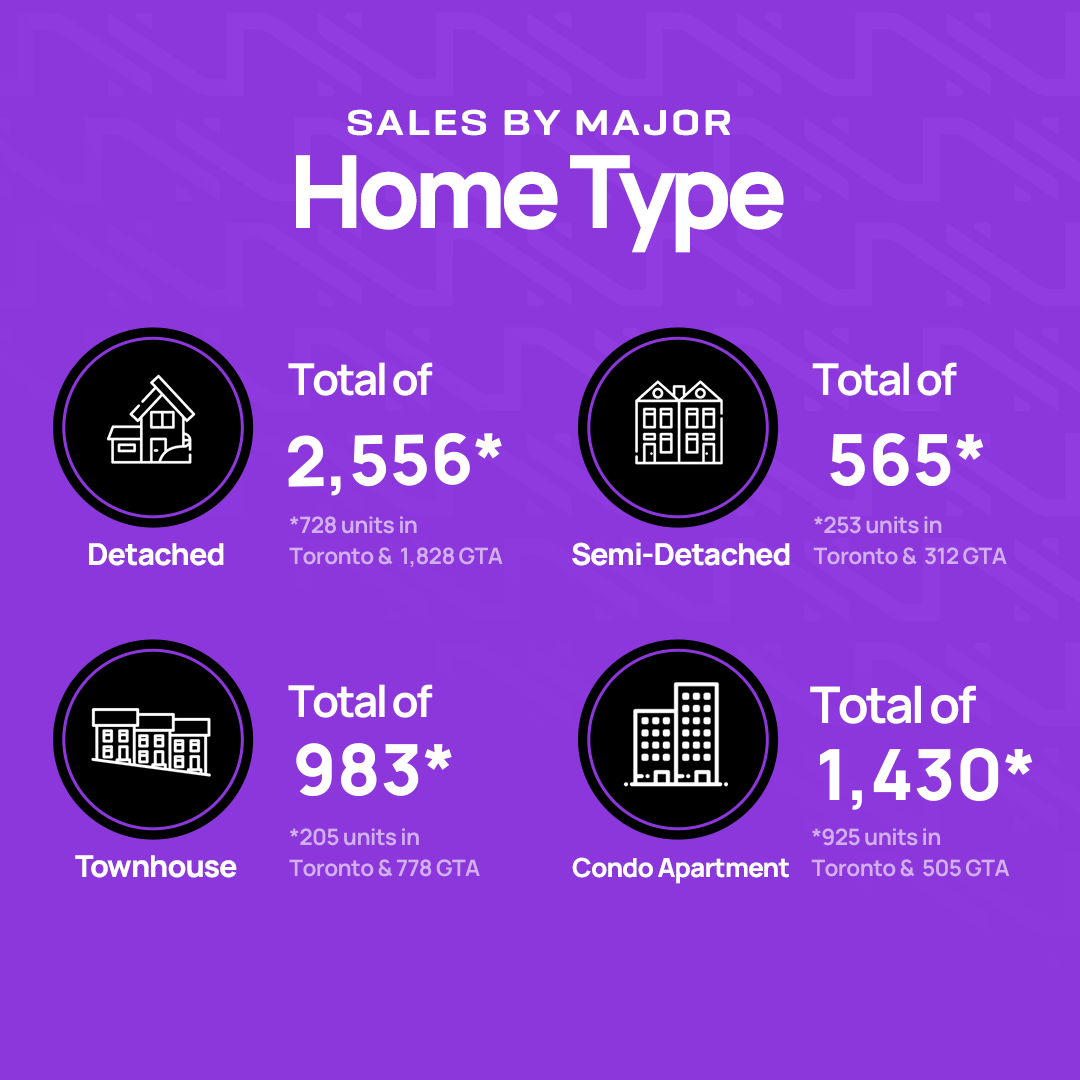

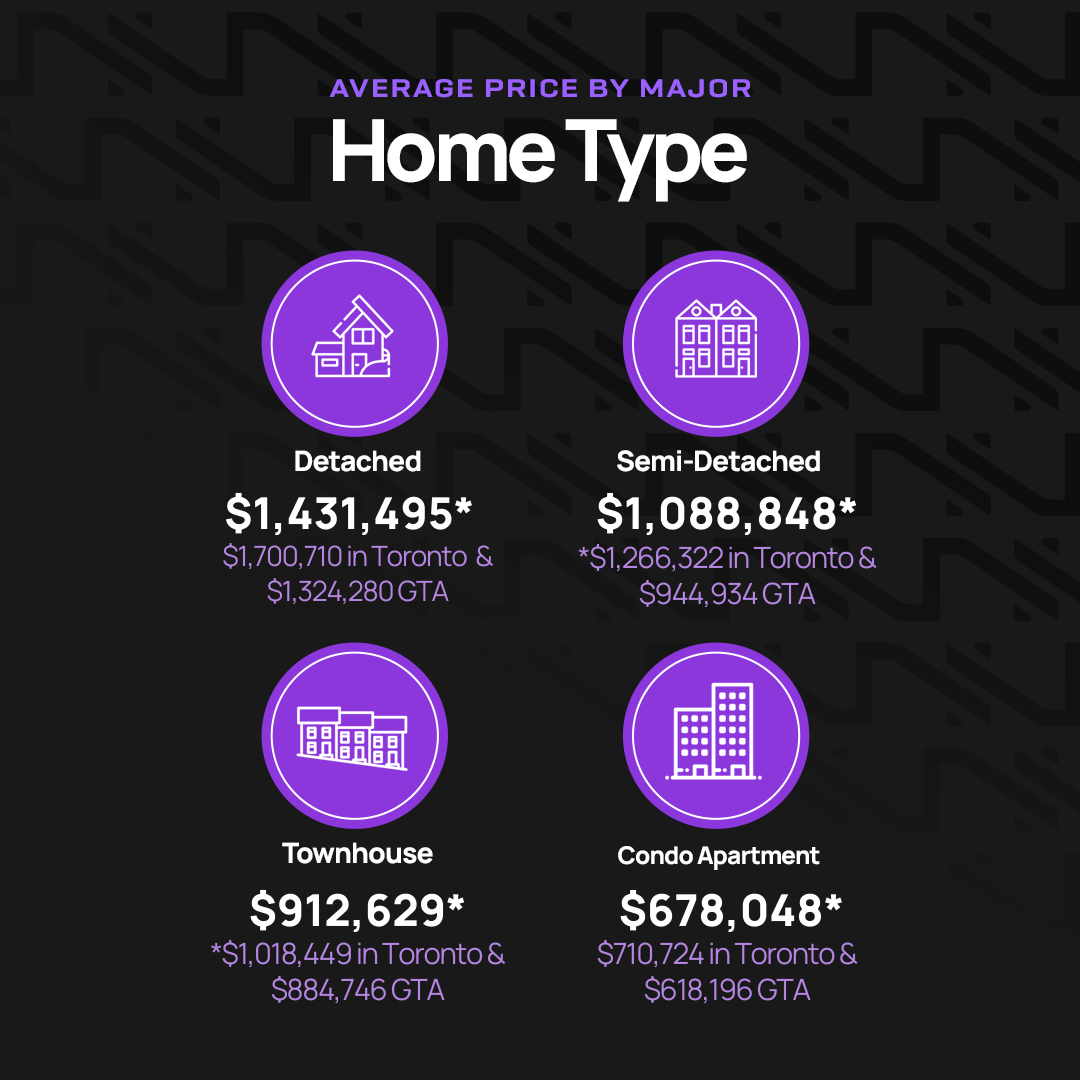

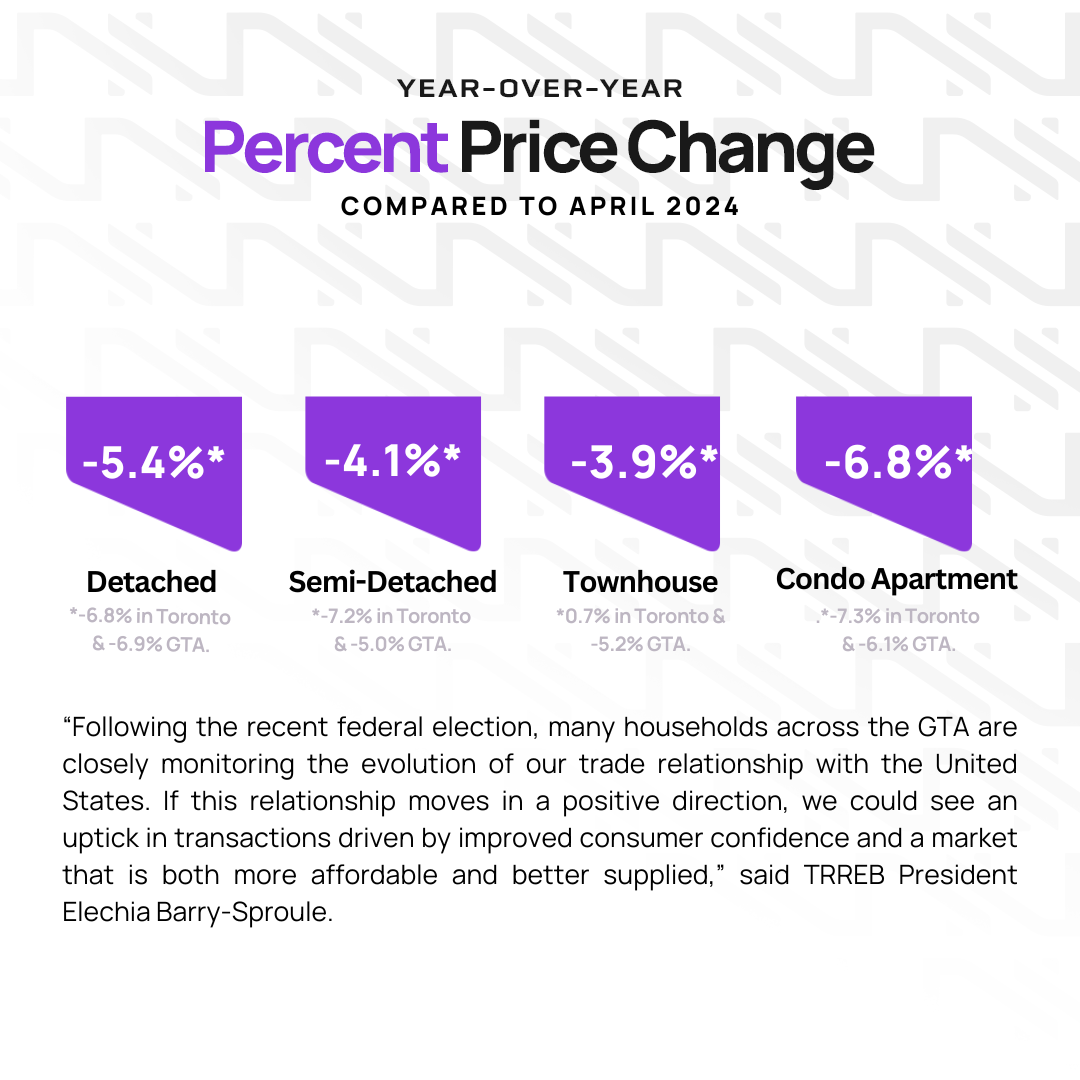

April brought a bit of a seasonal lift to the real estate market, with home sales ticking up compared to March. But when we zoom out and look year-over-year, things are still quieter than usual.

Here’s what you need to know:

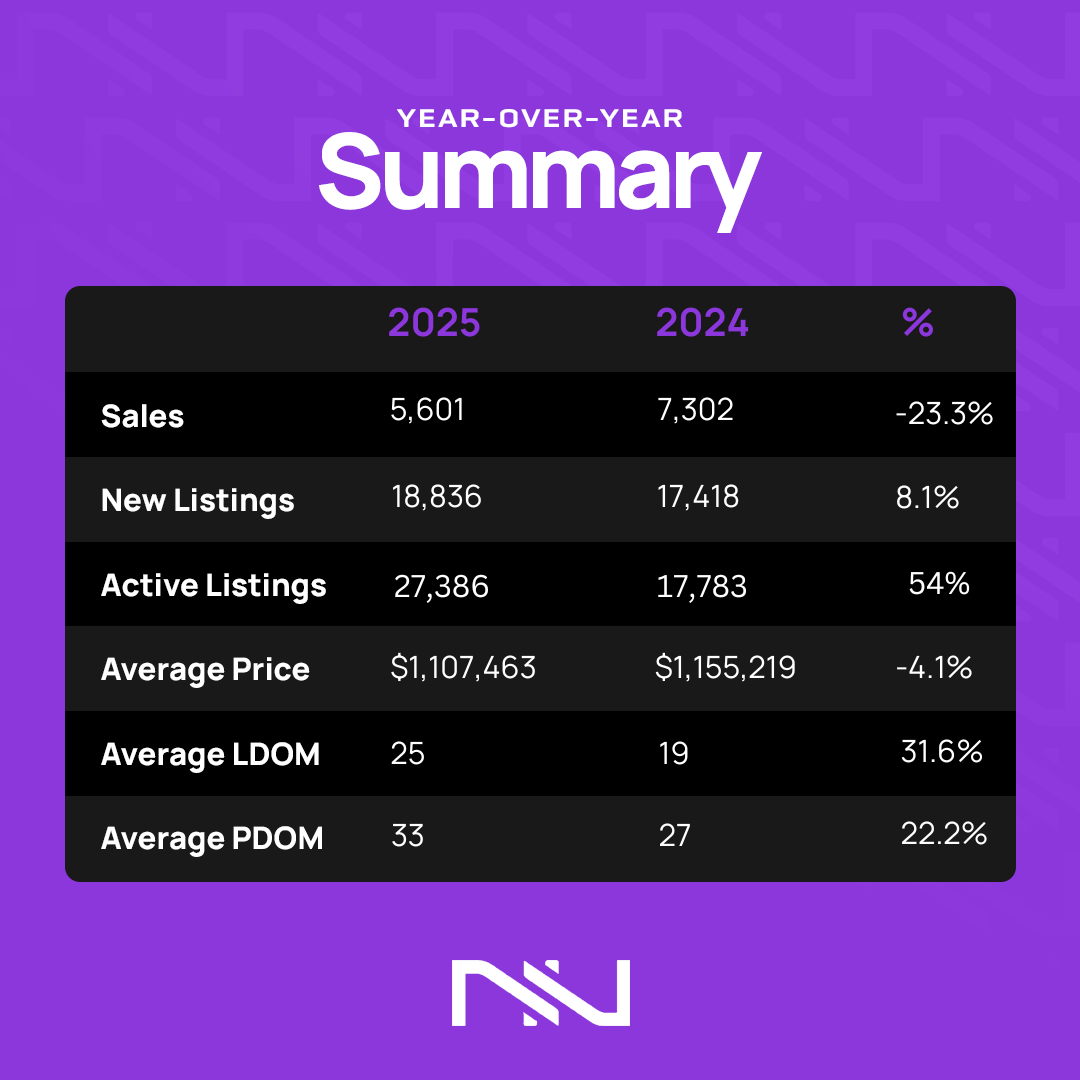

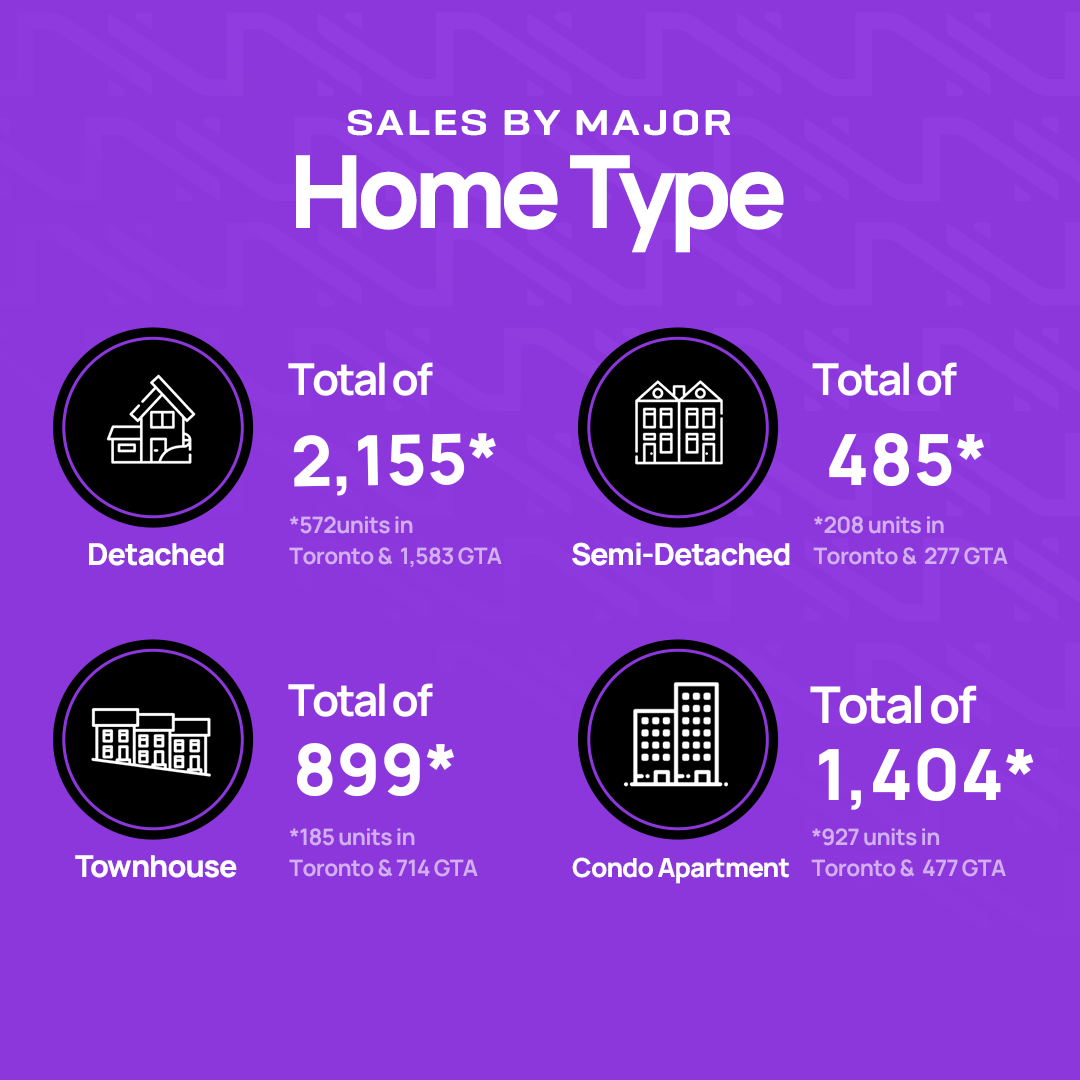

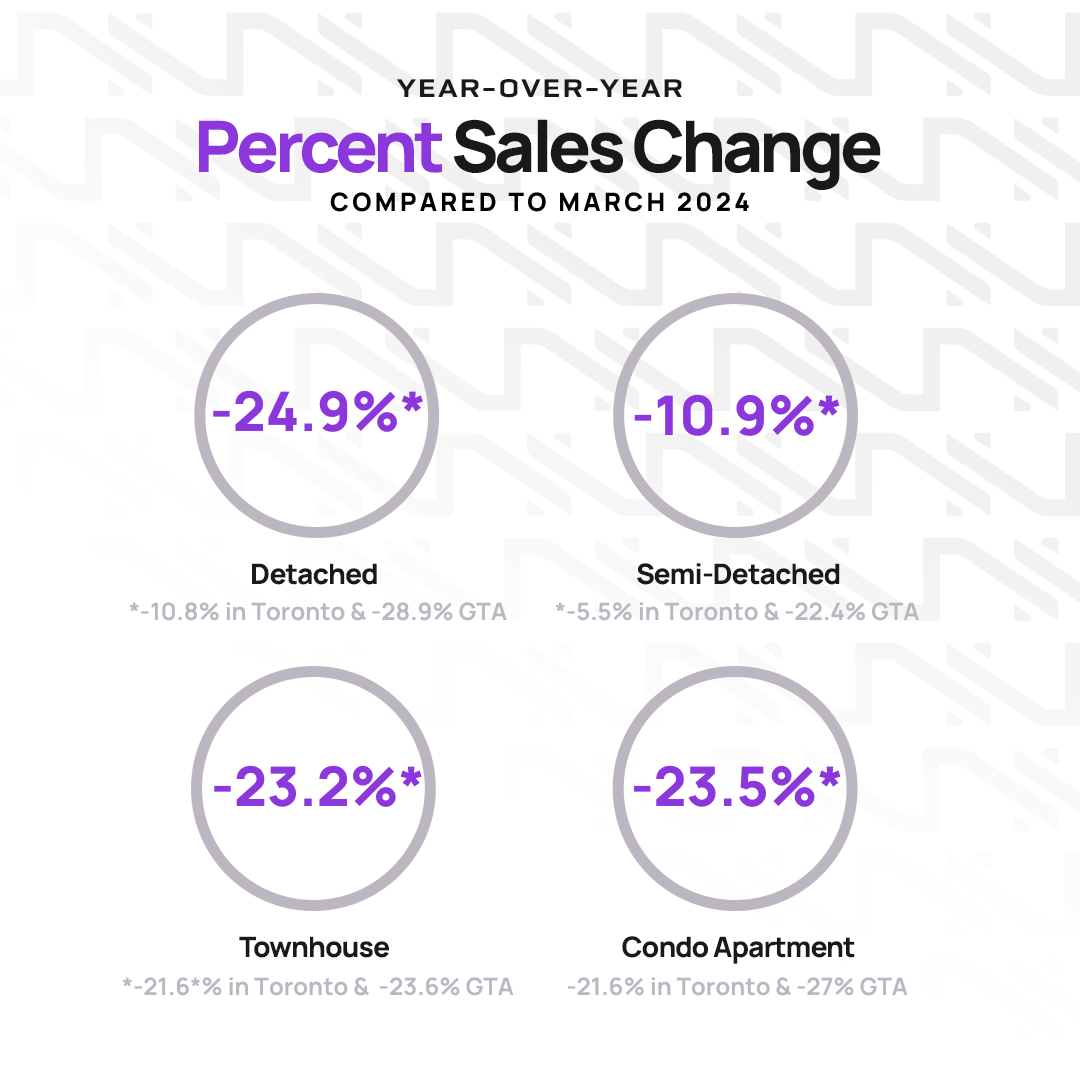

📉 5,601 homes sold in April – that’s down 23.3% compared to April 2024.

📈 18,836 new listings hit the market – that’s up 8.1% year-over-year.

📊 On a seasonally adjusted basis, sales inched up from March – so some momentum is building.

Many buyers are still sitting on the sidelines, waiting for interest rates to drop and for the economy to feel more stable.

TRREB President Elechia Barry-Sproule added:

“If our trade relationship with the U.S. improves post-election, we could see more confidence and a stronger market.”

So while listings are growing and spring is usually busy, this year’s market still feels a bit cautious.

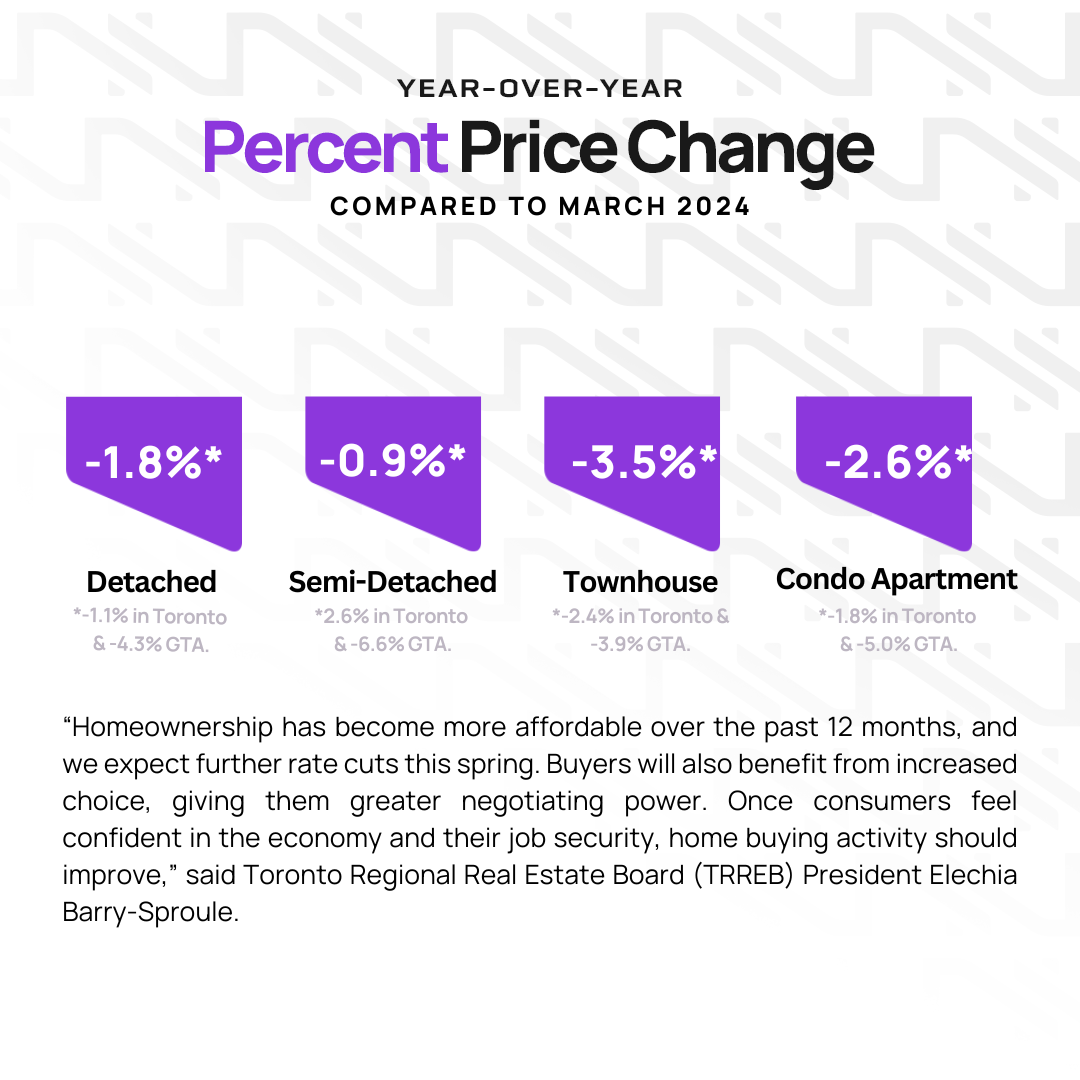

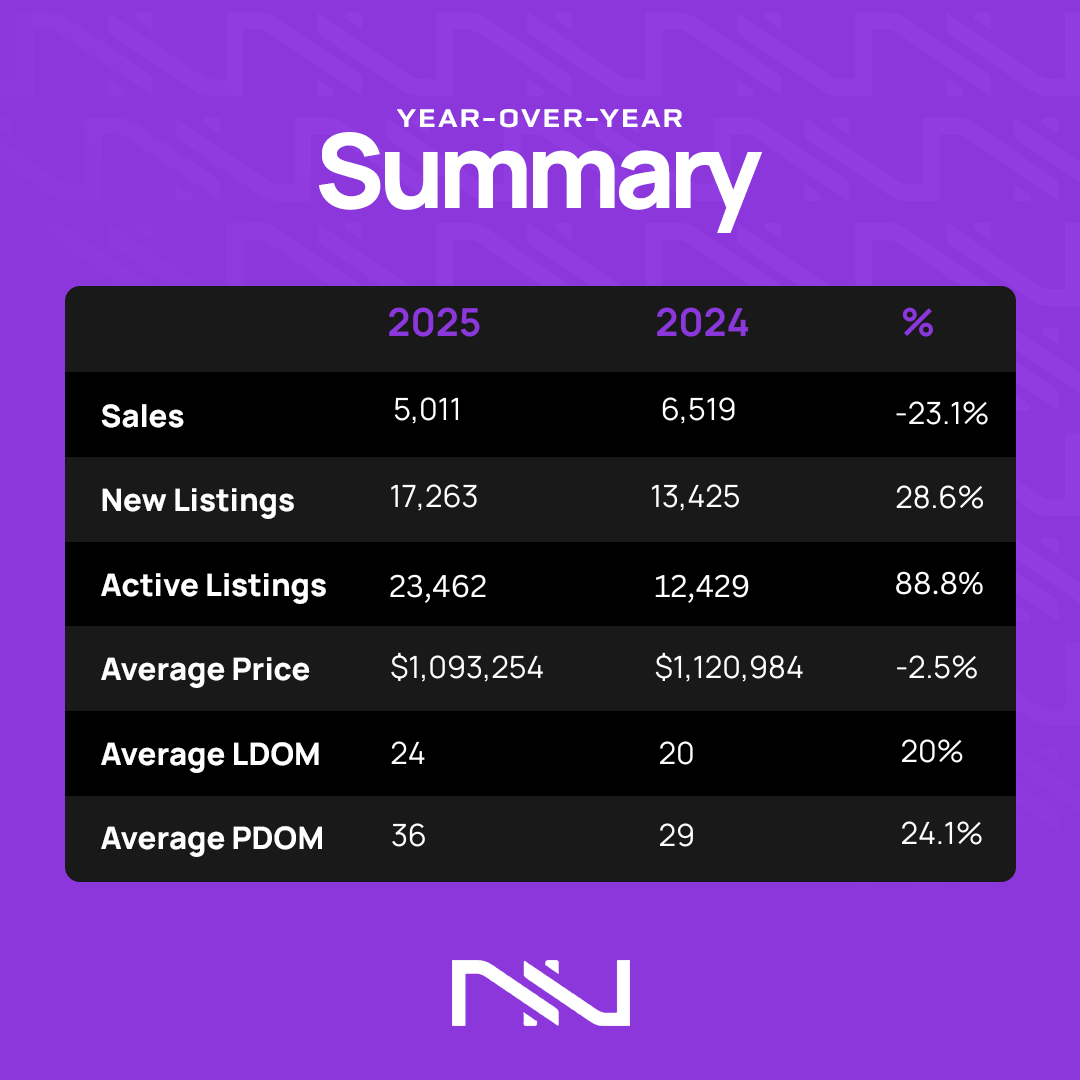

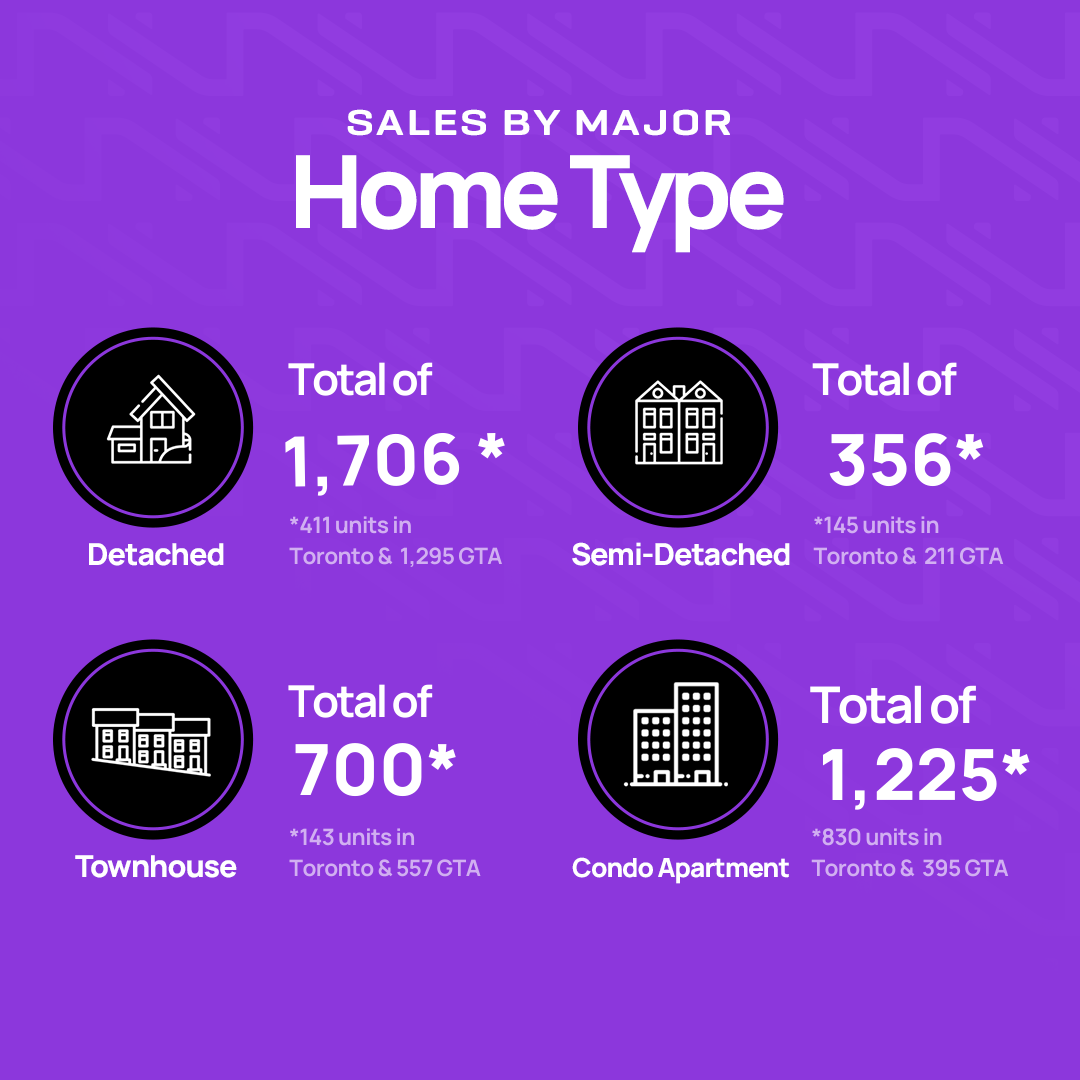

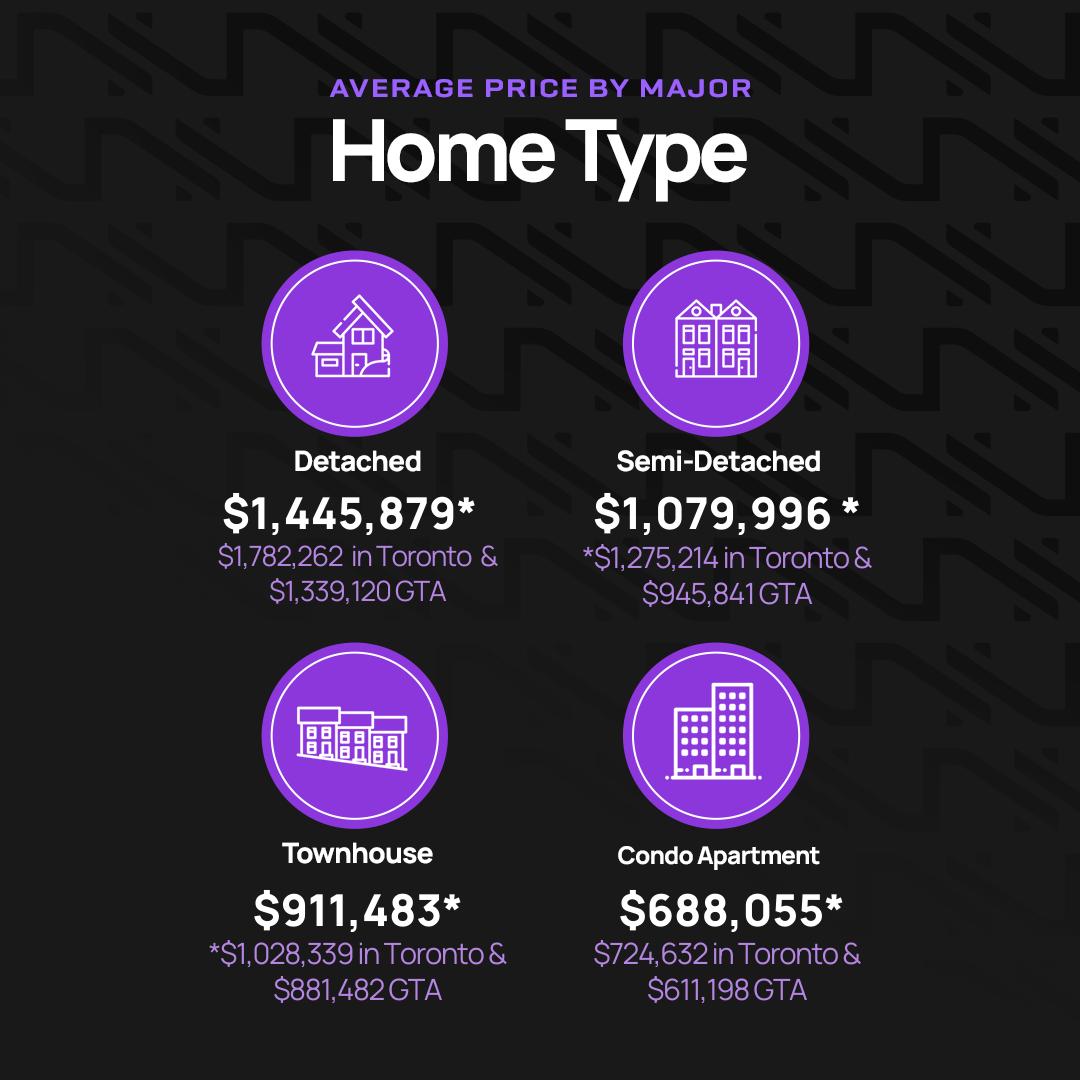

We’re back at it again with a review of Market numbers for the month of March. Let’s have a look at the numbers.

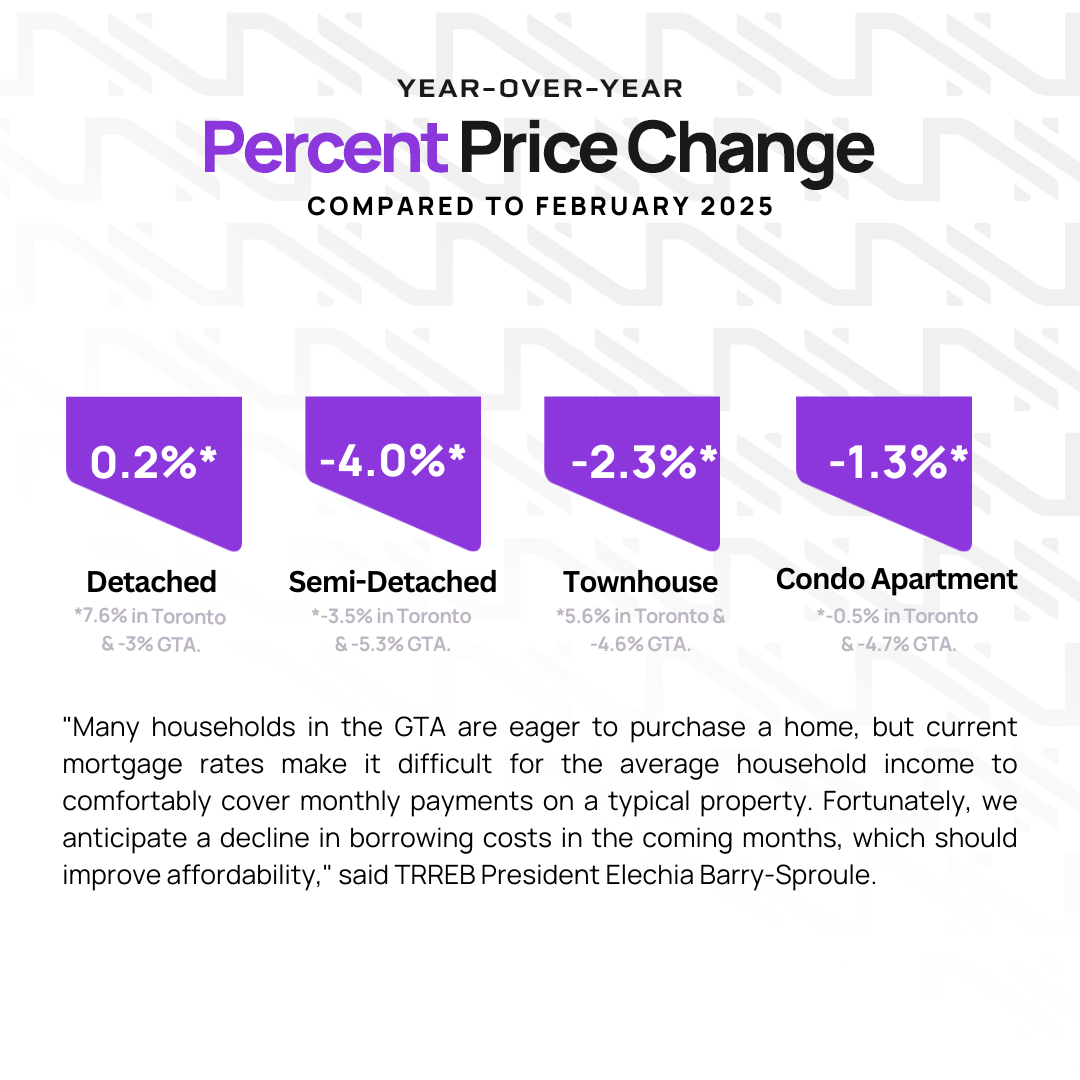

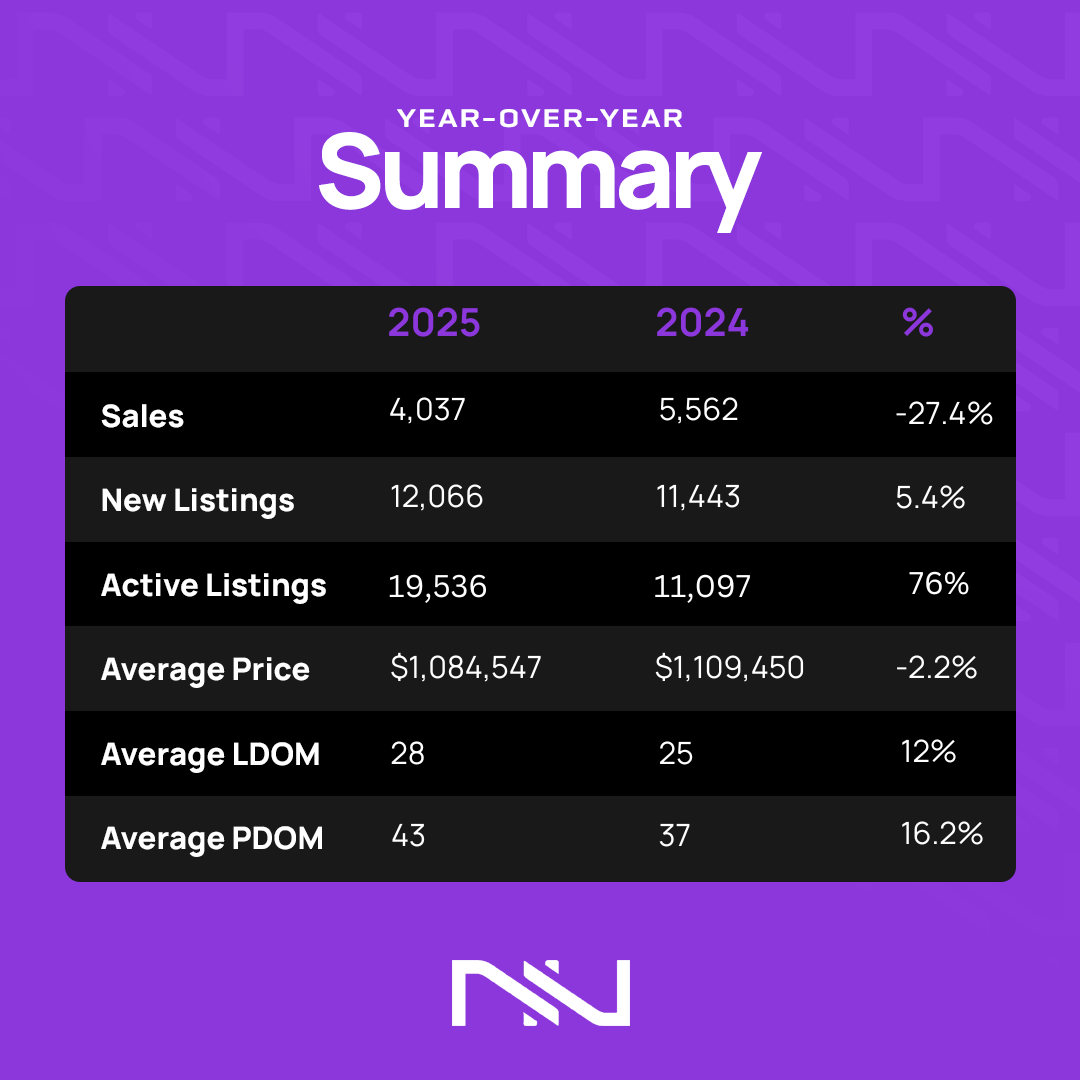

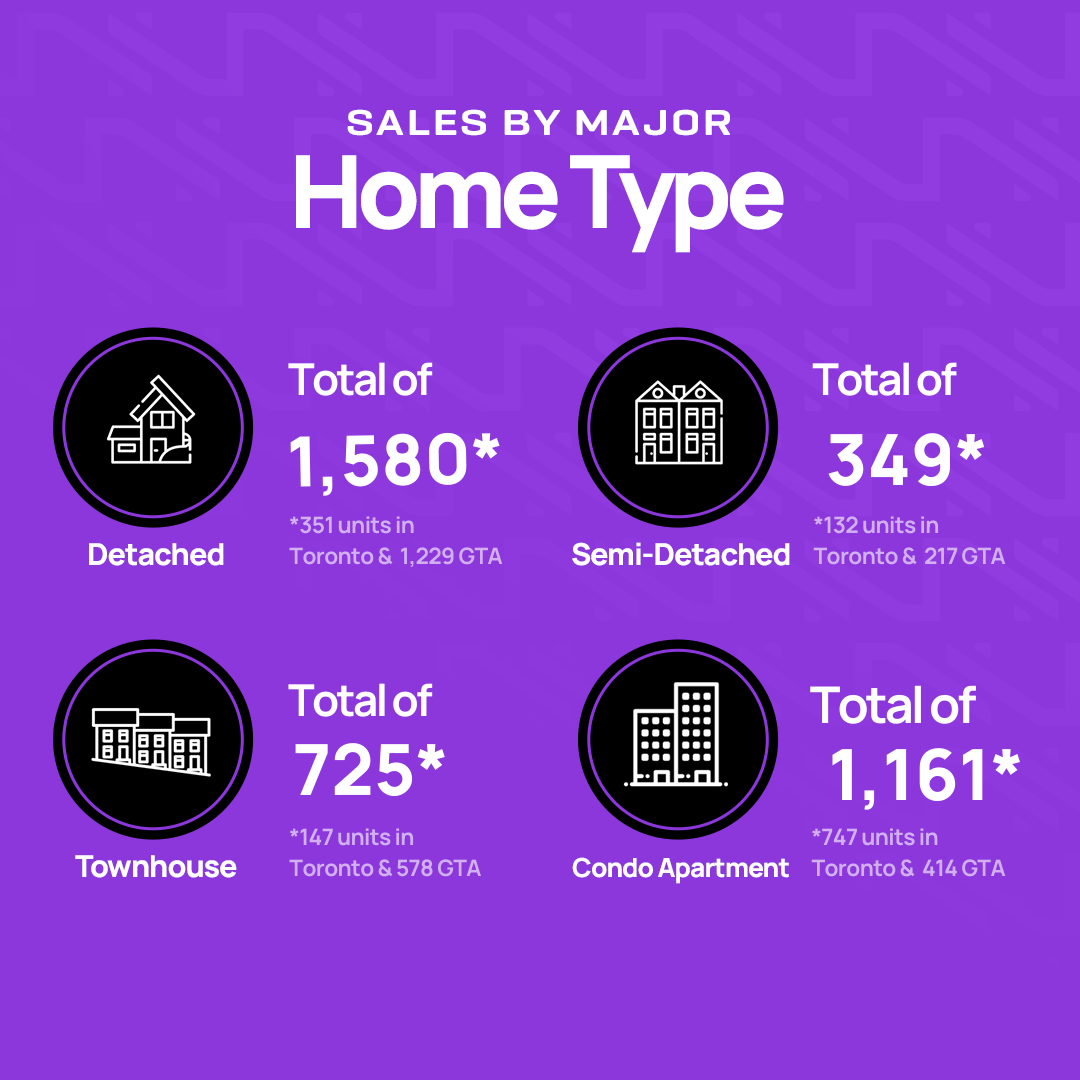

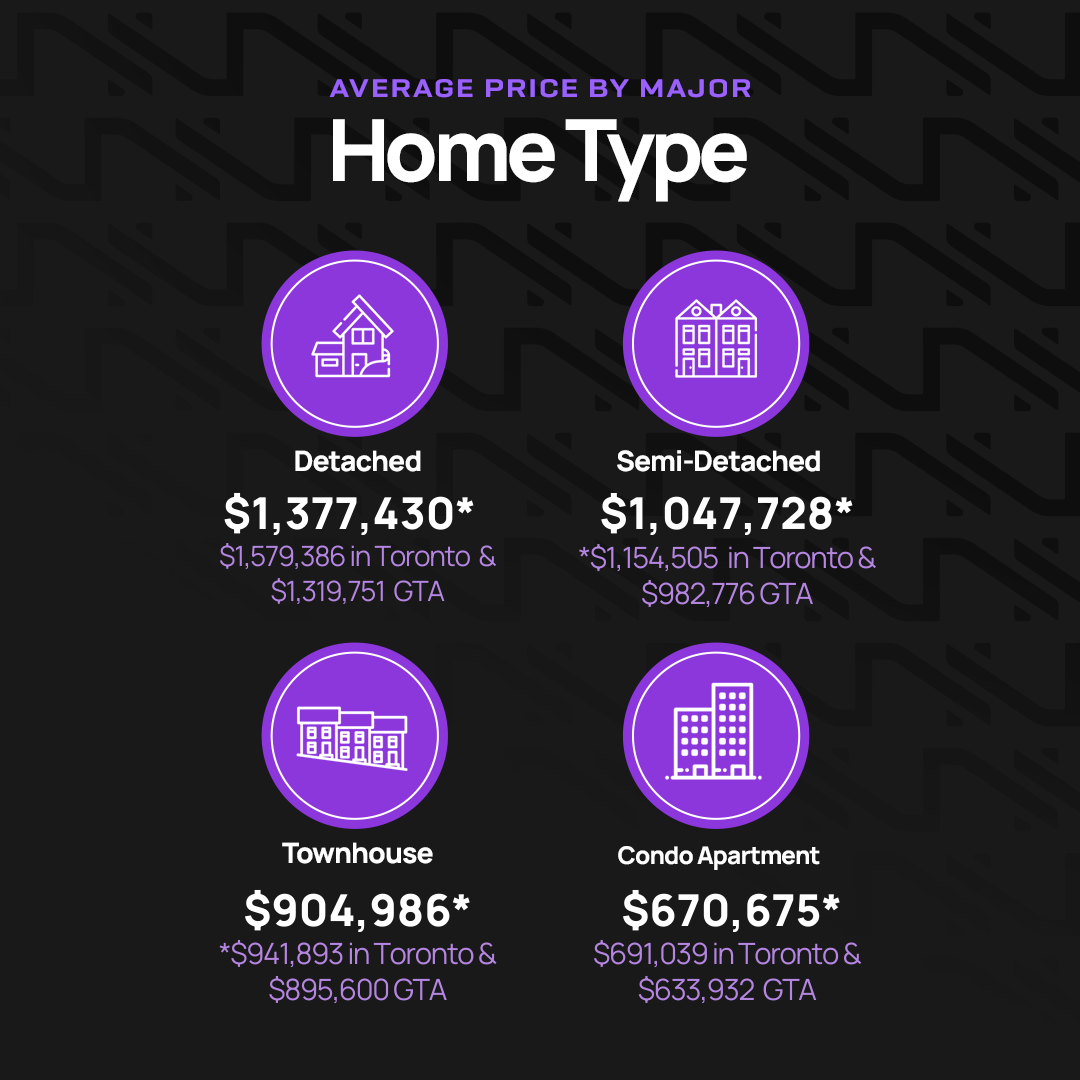

We’re back at it again with a review of Market numbers for the month of February. Let’s have a look at the numbers.

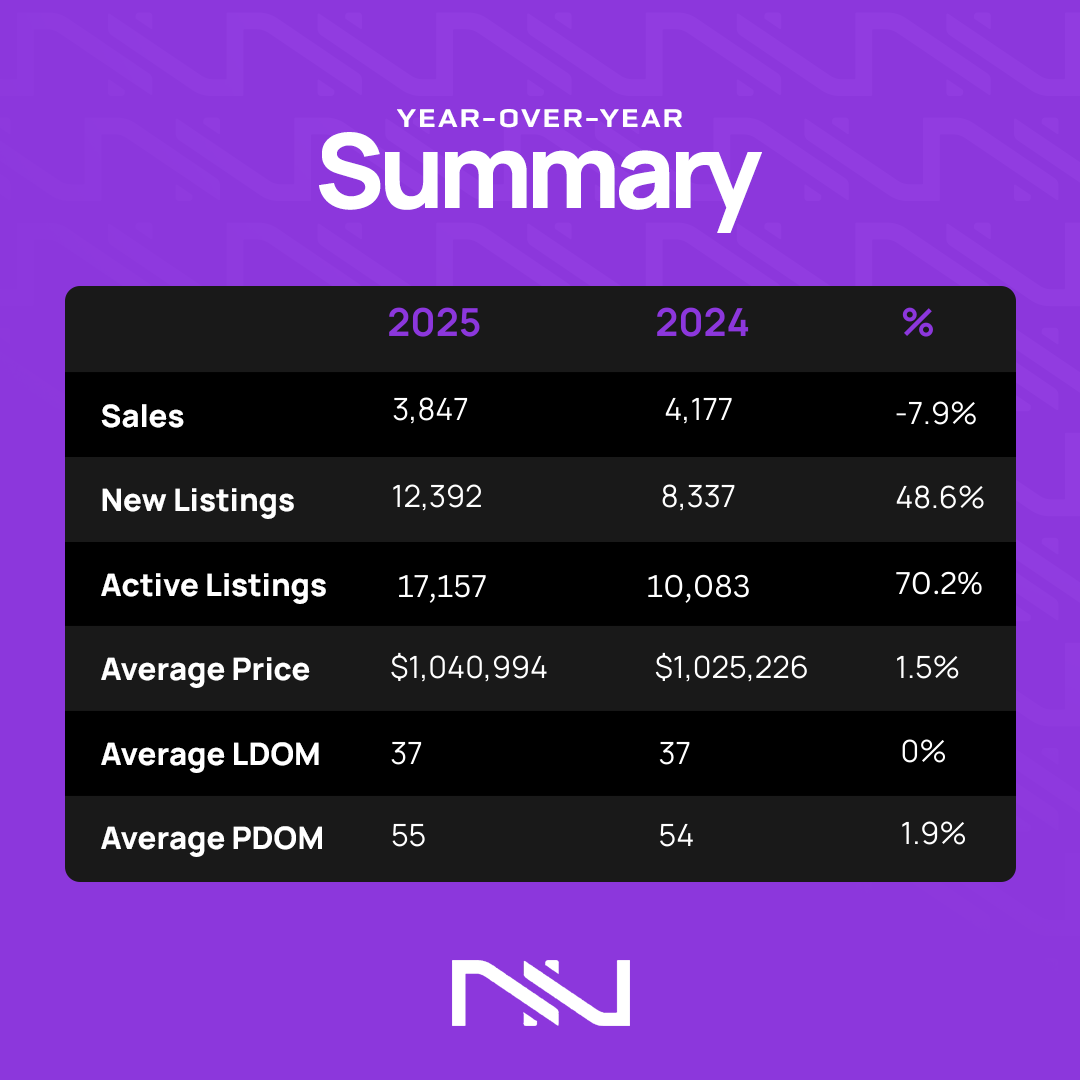

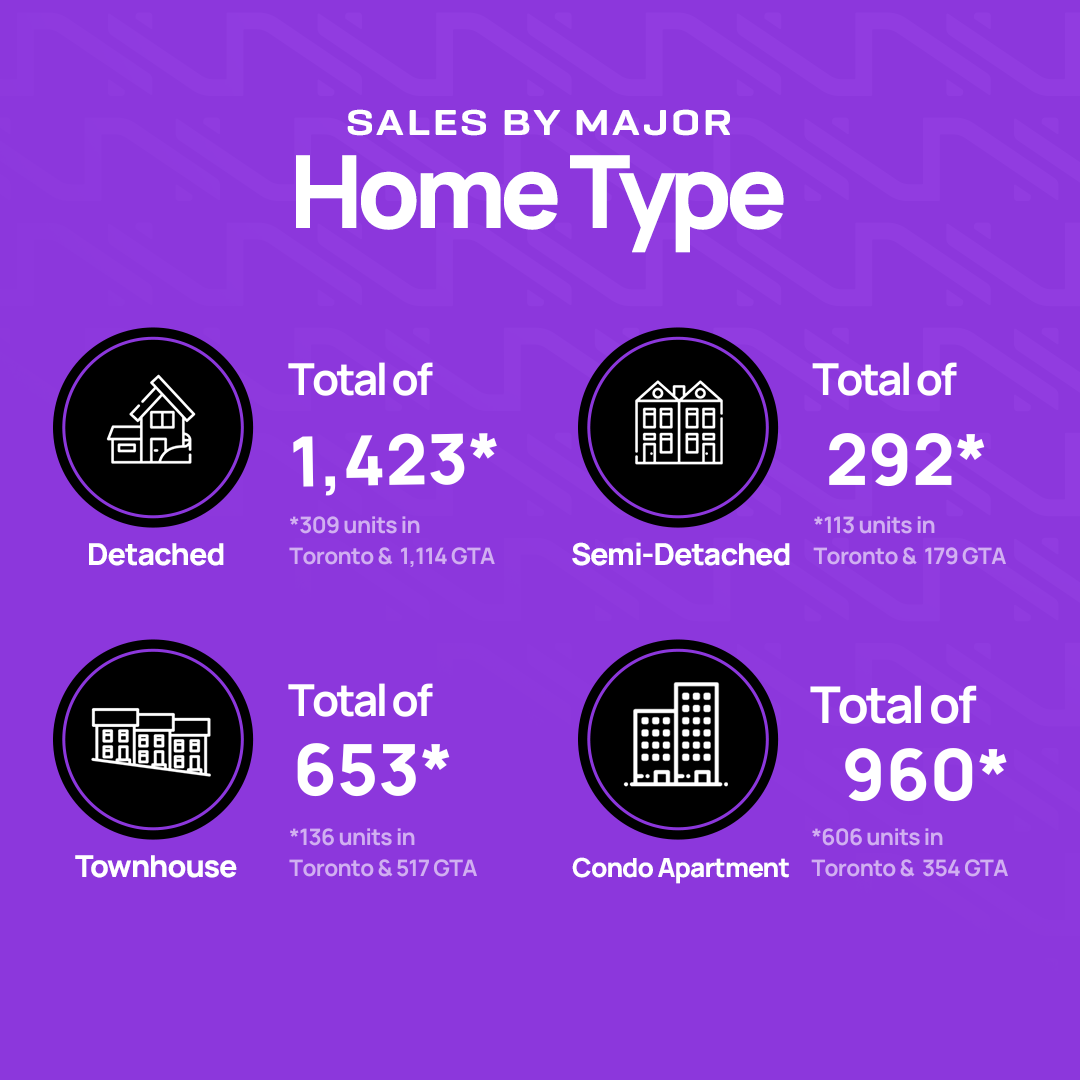

We’re back at it again with a review of Market numbers for the month of January. Let’s have a look at the numbers.

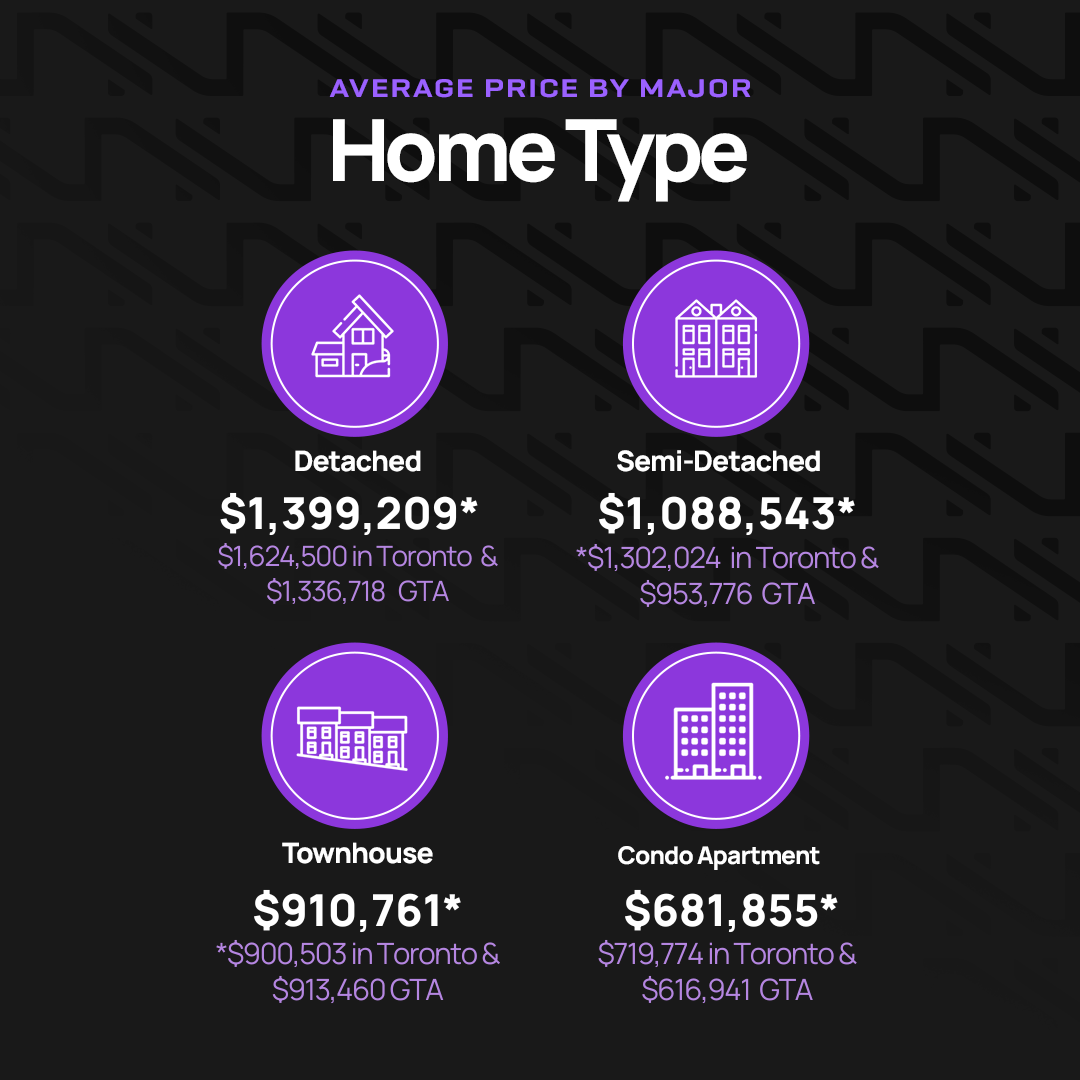

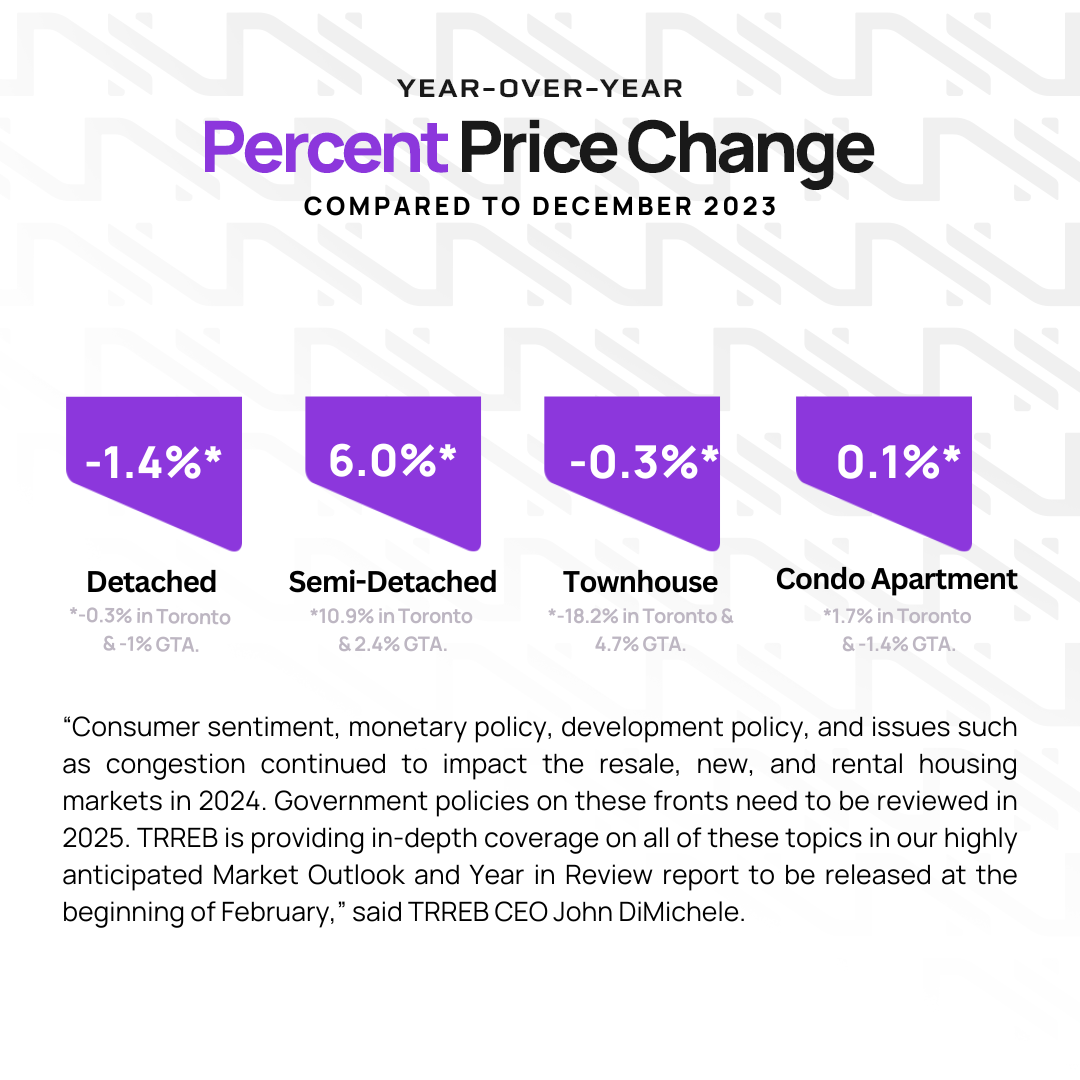

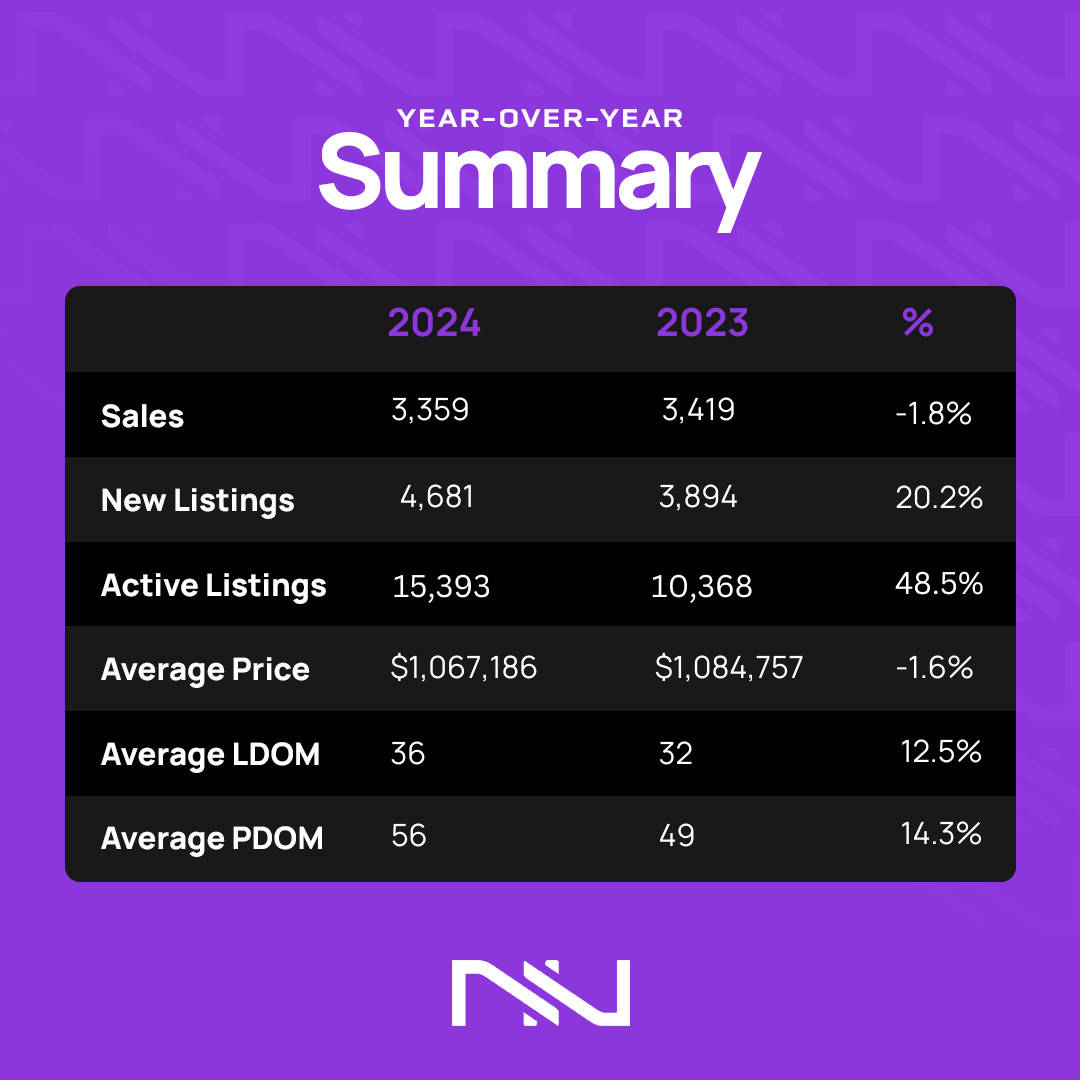

We’re back at it again with a review of Market numbers for the month of December. Let’s have a look at the numbers.

What's going on in the Real Estate Market? We saw a 2.6% Increase in the average sales price overall and a 40.1% increase in sales activity in November 2024 compared to the same period last year.

Most people expected prices and sales to soar once we started seeing interest rate drops. Many sellers expected buyers to just fly back to the market once rates started to drop. That didn't necessarily happen. Over the month of November, we saw a huge increase of 30% in the number of active listings on the Market.

When you break it all down, you realize there are a lot of Sellers that came to the table and that necessarily didn't sell their properties. Many listings are sitting on the market, which presents a huge opportunity for Home Buyers.

Overall, I believe we are in a Healthy market as we have been able to experience a little bit of everything in today's market. Buyers have options and Sellers do to.

We at Unna Real Estate Group believe that every situation is different and every neighbourhood is different and should be analyzed as such. Feel free to reach out to us any time so we can help you analyze your situation.