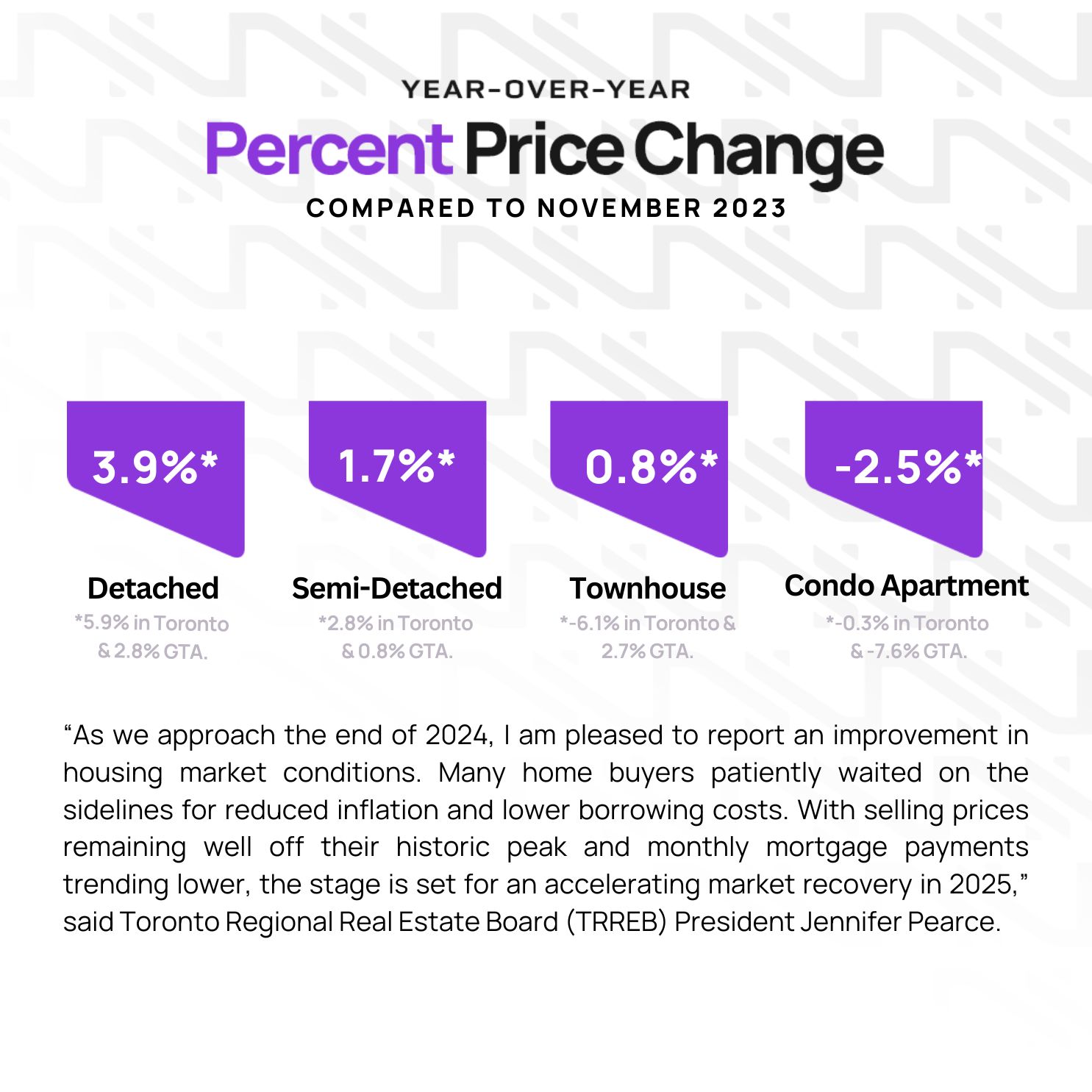

2025 is here, and big changes are coming to the real estate market! Experts believe this year will bring lots of opportunities for people looking to make a move in the Real Estate Market. Here’s what you need to know:

Great News for Buyers

This year, buying a home will be easier, especially if it’s your first time. New programs are available to help first-time buyers. Plus, changes to mortgage rules mean qualifying for a home should become a little bit easier with amortization changes and insured cap changes.

Lower Interest Rates

Interest rates are expected to continue to go down in 2025. This is excellent news because lower rates mean smaller monthly payments and more money to spend on your dream home. The lower rates are expected to bring some buyers to the market.

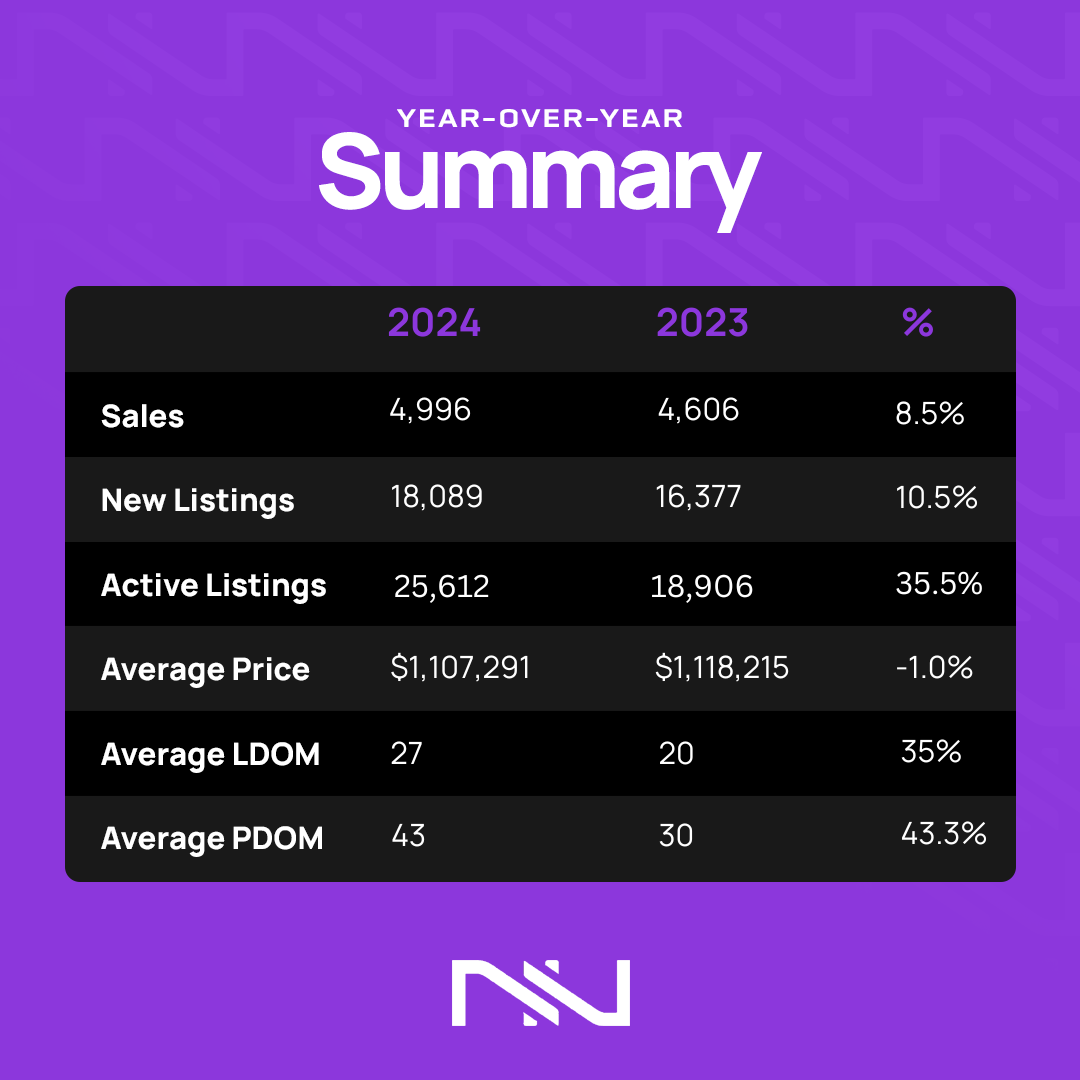

More Homes for Sale

Many Canadians will need to renew their mortgages this year, but some will have to pay higher rates. Because of this, more people might decide to sell their homes. This means there could be more homes on the market for buyers to choose from.

We are looking for a balanced market in which a good number of homes are available for sale for the number of home buyers currently looking.

Making the Most of 2025

If you’re considering buying or selling a home, 2025 is a great time to do it. There are new rules and programs to help buyers, and more homes might be available. Working together with your preferred realtor to create a plan can make the process easier and help you find the best deals.

At Unna Real Estate Group, we’re here to help you every step of the way. Whether you’re buying your first home, selling your current one, or just exploring your options, we’re ready to guide you. Let’s make 2025 your year to achieve your real estate dreams!

Ask us how we have helped hundreds of clients upgrade to their new homes using our Uprise Method.