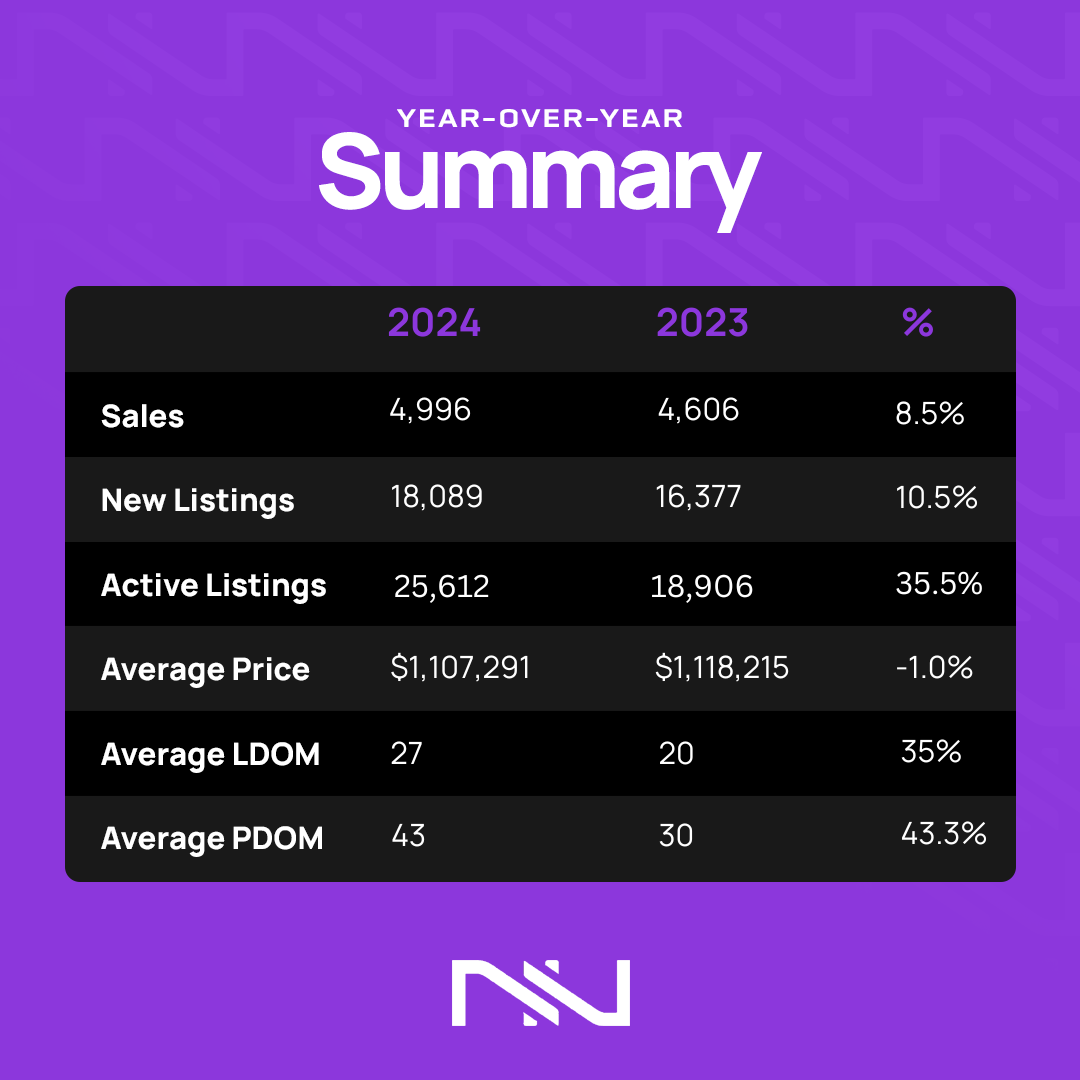

During a season when change is normal, we expect to see the leaves changing colours, and the weather begins to change, but now our Real Estate Landscape in Ontario looks like it's changing as well.

Recently we've experienced a few rate drops in interest rates with economists saying we shall see more to come. Canada's inflation rate dropped to 1.6% in September, and we've seen a bunch of new mortgage rules that will come into effect shortly. We covered most of the mortgage rule changes in a previous article which can be found here: https://unnarealestate.com/blog.html/news-for-first-time-home-buyers-8289247

One more major mortgage rule change was announced after we published that article. The announcement of the removal of the Mortgage Stress Test when Renewing your mortgage. That is Huge news for homeowners.

Switching Lenders Without Stress Test Borrowers will also benefit from the ability to switch mortgage lenders at renewal without having to undergo another stress test. This change is designed to foster competition among lenders, offering homeowners more flexibility to find better mortgage rates without the barrier of requalification. This is expected to be especially beneficial for those in high-interest-rate environments.

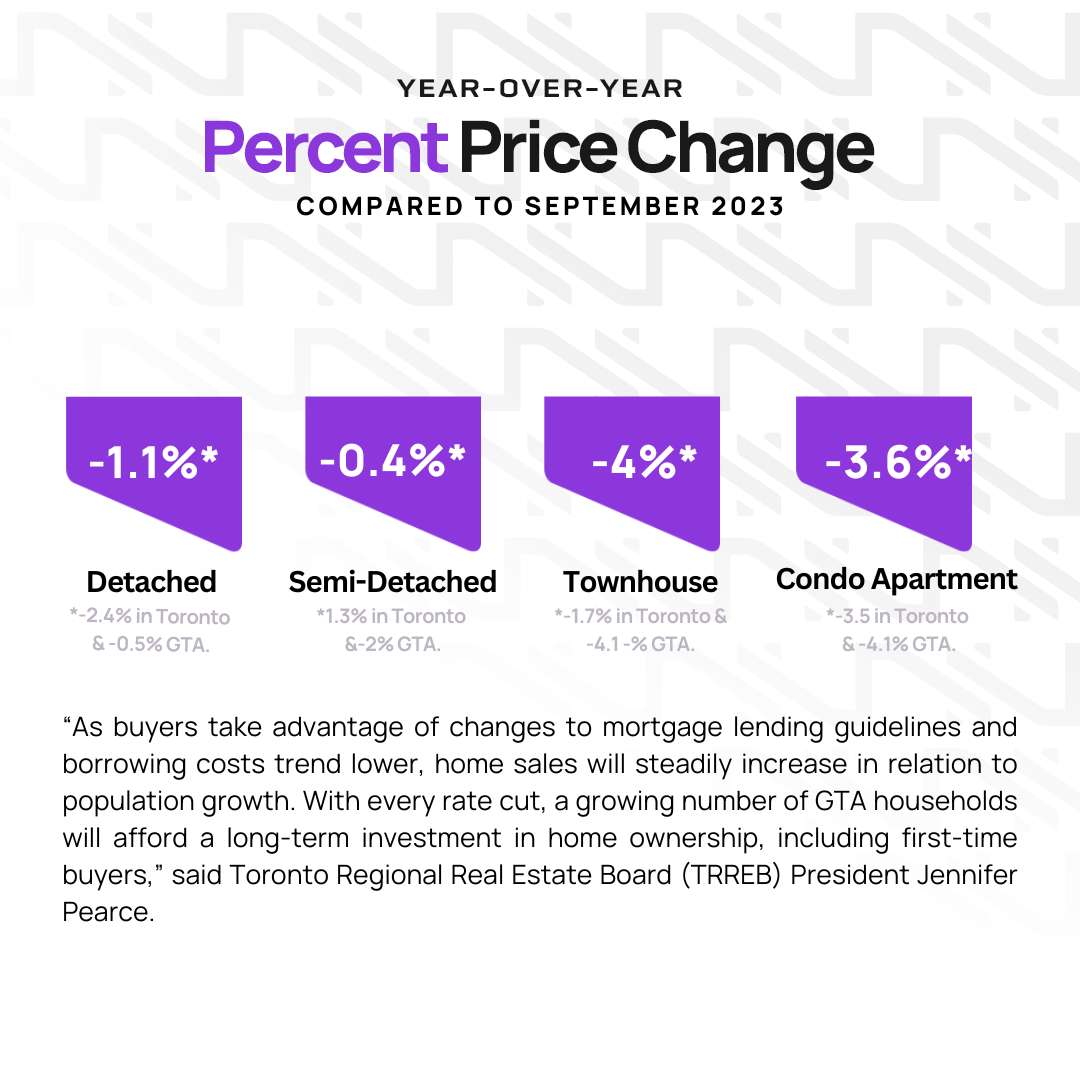

What Does This Mean for Ontario Homebuyers? These reforms are designed to improve access to homeownership amid soaring housing prices. However, there are concerns that increased buying power might lead to further price inflation, particularly in already tight markets like Toronto. As these rules roll out, buyers and investors alike should carefully consider how these changes align with their financial goals and housing plans.

If you’re considering purchasing a home or renewing your mortgage, these rule changes could impact your strategy. We at Unna Real Estate Group are here to help you navigate the evolving market and make informed decisions that suit your needs. Feel free to reach out anytime.