On Wednesday, September 4, 2024, the Bank of Canada announced its third consecutive rate reduction, reducing the key interest rate to 4.25%. It's the third cut since June and the first time the central bank has posted three consecutive reductions since the 2009 global financial crisis.

The rate reduction comes shortly after the recent inflation announcement which gave some hope that our economy is improving. The Bank of Canada governor also mentioned that if the economy continued to improve, we might continue to see some more rate cuts. Their next announcement will be October 23, 2024.

Overall, I strongly believe the rate reduction is good for everyone. There is also a lot of talk about rates coming even lower in 2025, which may be possible. I believe a healthy interest rate is somewhere between 3-4%.

Now, what does this mean for you? Well, it really depends on what kind of situation you're in. I always strongly recommend people to speak to a professional whenever they are thinking about their financial situation, whether it be investing in Real Estate or other investments. Dont be distracted by the media and by what everyone around you is doing... Remember, not long ago, interest rates were almost Free, and they were telling us to take the free money, and many people got hurt.

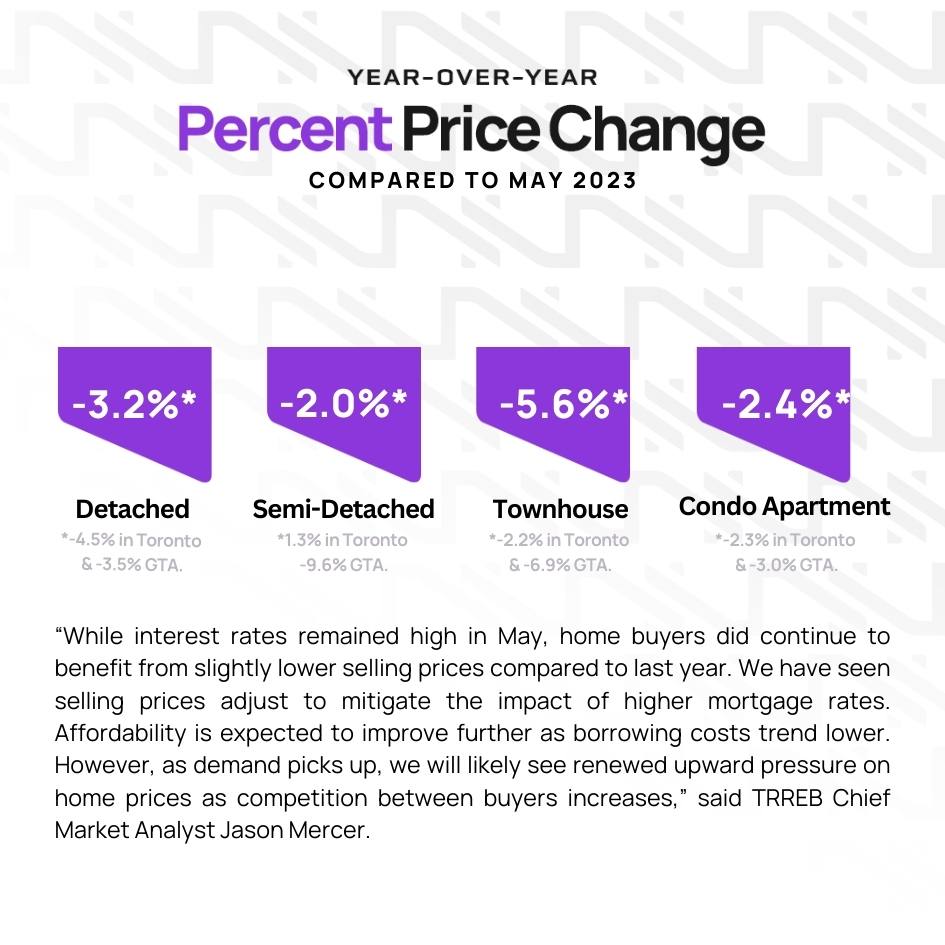

Always analyze your personal situation. Sometimes, getting your foot in the door is better than waiting around for the perfect time or perfect interest rate. There also tends to be more activity as interest rates drop, which normally leads to price increases in the Real Estate Market.

Either way, at Unna Real Estate Group we're always available to chat with you about interest rates, Real Estate market or answer any other questions you might have. Feel free to reach out to us anytime.