We’re back at it again with a review of Market numbers for the month of May. Lets have a look at the numbers from the first month of Spring.

We’re back at it again with a review of Market numbers for the month of May. Lets have a look at the numbers from the first month of Spring.

Laneway & Garden Suites in Toronto

(Laneway & Garden Suites… What are they? Why are they becoming so popular?)

The housing crisis in the Greater Toronto Area, particularly in the city's core, persists despite market changes, with property values remaining high and homeownership challenging for many.

In response to financing challenges, homeowners have explored options like secondary units to generate extra income for mortgage support, with basement or second-floor apartments traditionally being popular choices.

The Changing Lanes Program introduced by the City of Toronto in 2018 allows homeowners to build Laneway Suites, providing new rental housing options within established neighbourhoods.

A Laneway Suite is a self-contained residential unit situated on the same lot as the main house, typically located in the backyard next to a public laneway, offering additional housing choices.

The Changing Lanes program simplifies the process for homeowners to construct a laneway house without the need for various approvals, making it easier to enhance their property.

Homeowners interested in building a Laneway Suite can reach out to the City of Toronto to determine eligibility based on property criteria.

For properties without access to a laneway, the City of Toronto introduced Garden Suites in 2022, offering detached housing units in the backyard as an additional housing option.

Garden Suites, like laneway suites, provide smaller housing units that can accommodate family members or serve as rental units, aligning with the city's efforts to diversify housing options.

Both Laneway and Garden Suites contribute to various housing factors, increasing property value, expanding rental opportunities, and enhancing homeowners' financial flexibility.

These initiatives offer additional housing solutions and benefits to homeowners, tenants, and buyers in Toronto's competitive real estate market.

As always, different rules and regulations apply on every property, feel free to contact us to discuss this or any other Real Estate Related topic.

Some Key Roles in the Real Estate Industry:

(Choosing your dream Team that works for you)

When it comes to your personal Real estate journey, it is usually the most important decision you make in your whole life. Although we at Unna Real Estate Group buy and sell real estate every day, we understand that this process is very important to you and can sometimes be confusing to get started.

At Unna, we believe that choosing the right team of professionals is key to making sure that everything is a success. We have compiled a list of other Real Estate professionals who are usually involved in a real estate transaction. It is important that every single person in your team communicates with one another so you have a seamless experience.

The Listing Agent:

Works with individuals selling real estate, listing properties under their name and brokerage for potential buyers to discover.

Responsibilities include determining selling prices, listing and marketing properties, managing showings, answering buyer inquiries, negotiating sale prices, and overseeing the sales process.

The Buyer Agent:

Assists individuals looking to purchase real estate by finding suitable properties, arranging showings, negotiating on their behalf, and guiding them through the purchasing and closing procedures.

Typically, buyer clients do not incur costs for working with a buyer’s agent.

The Broker:

Positioned above agents, brokers usually possess more education and licensing.

Brokers can establish their own real estate brokerage and recruit agents as salespeople.

The Mortgage Lender:

Provides funds for mortgage loans, essential for real estate purchases.

Prospective buyers are advised to obtain pre-approval for a loan before engaging in property viewings and bidding.

The Appraiser:

Independently assesses property value, crucial for mortgage lenders to ascertain accurate property valuations.

The appraiser's role is vital to ensure the property’s value aligns with the contracted sales price for loan approval.

The Inspector:

Hired by potential buyers to assess property structure, safety, and potential defects or damages.

Inspectors play a critical role in informing buyers of any issues that may affect the property's condition.

The Closing Attorney (The Lawyer):

A real estate attorney specializing in real estate law, providing legal guidance during property transactions, particularly at the closing stage.

These attorneys assist buyers and sellers in understanding and navigating the legal documentation involved in real estate transactions.

When to Sell Your Home…

(when is the best time to sell my home?)

The question of when is the best time to sell my home comes up almost every single day, the truth is there is no black-and-white answer to this question but this may help you find the right answer.

Some people buy a home to eventually sell it and turn a profit. This can be a very lucrative idea when the market is right, but if more people are selling than buying, it can be particularly tricky.

Not everyone wants to hold onto a home for their lifetime. The real estate market can herald a lot of money when the timing is right, and for someone who is comfortable with the process of selling and buying again, this can be a very exciting possibility. It is, however, important to understand how the timing can influence the value of your home.

A good rule of thumb: when in doubt, talk to a Professional. If there are ever any questions on the fluctuating market, your Sales Representative can answer them all. It is always important to contact your preferred Real Estate Professional. The one you trust most.

There are so many factors to keep in mind when trying to figure out the best time to sell your property. Remember that it will always depend on your specific neighbourhood and even the type of property you want to sell.

With this in mind, there are a few chief rules to consider when finding the right time to sell your home:

- Is the market good for selling? For example, are there more people looking to buy than sell?

- Will you be buying a new home once your existing one is sold?

- Is there a better time to sell your home? (i.e. will you make more of a profit if you hold onto the property?)

Selling a home can be exhausting, but with the right advice and a good guide of current market values, you can make the selling experience comfortable and stress-free.

We at Unna Real Estate Group are always ready to answer all of your questions and concerns. Feel free to contact us anytime.

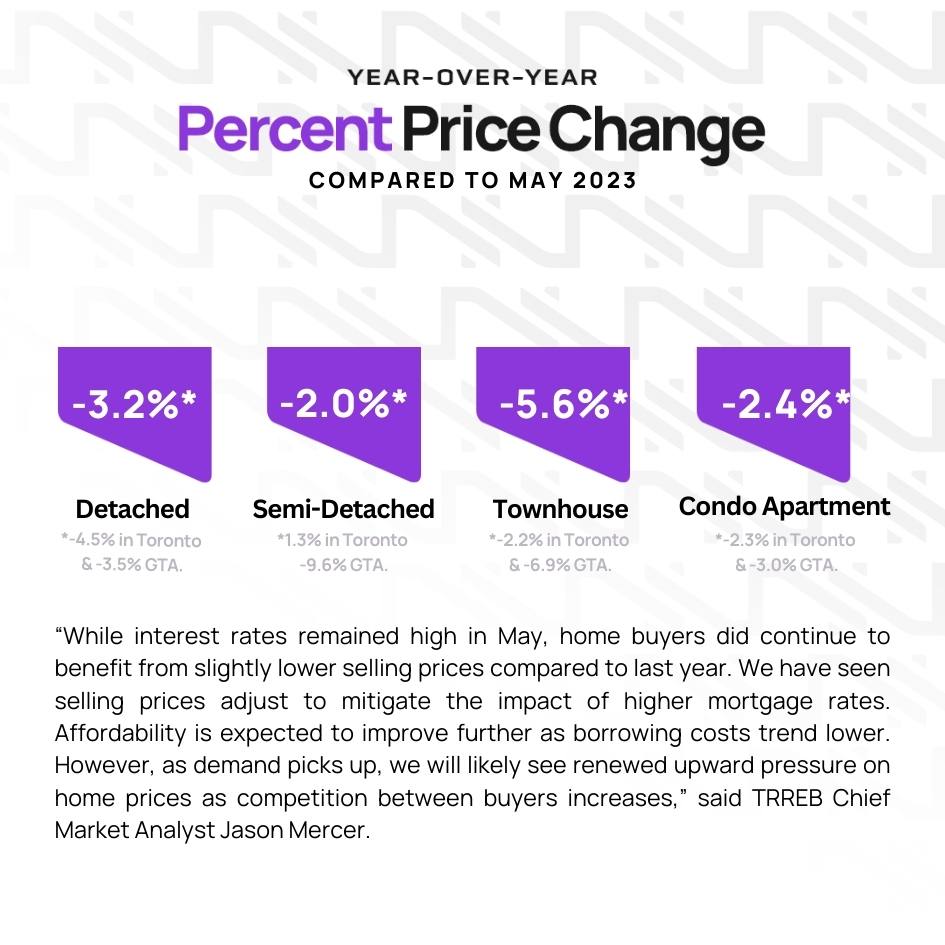

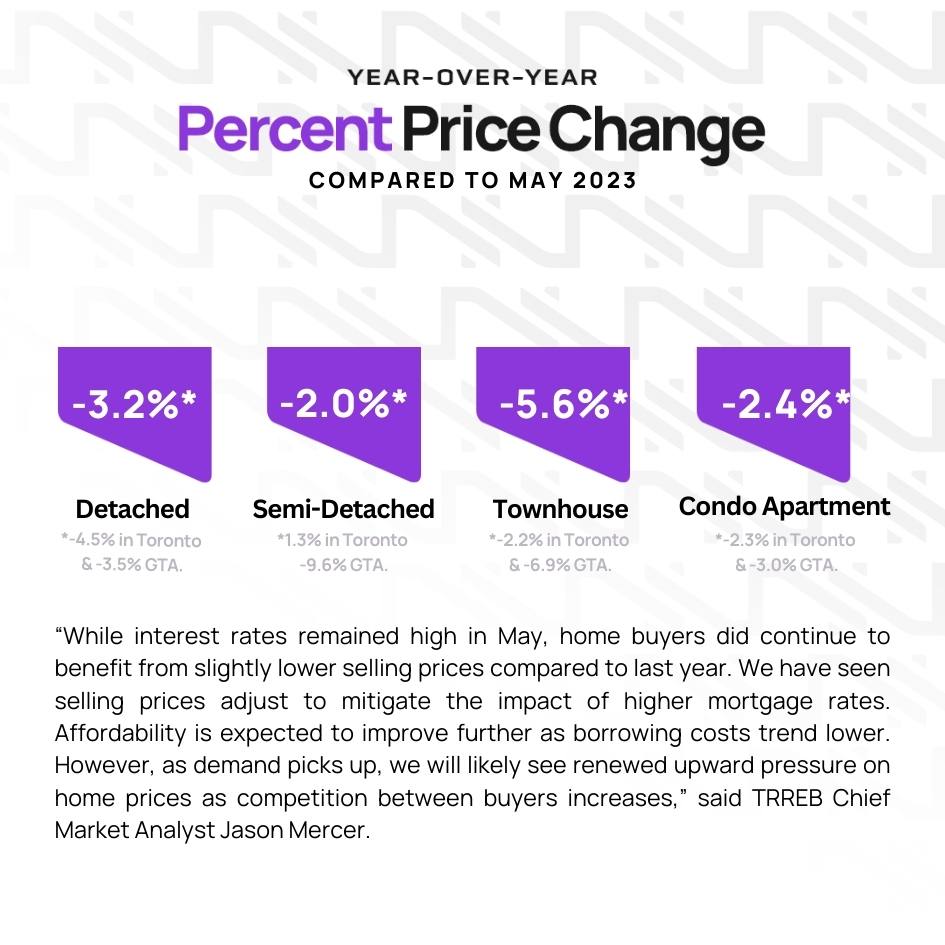

As you may know, the Bank of Canada reduced the overnight lending rate from 5% to 4.75%. It continues to focus on elevated shelter costs as a significant contributor to inflation. However, it also noted that inflation measures are showing signs of downward momentum and are close to historical averages. To better understand how it works, we have asked one of our mortgage agent partners Lorena Sarnaglia to breakdown the numbers.

Variable-Rate Mortgages - If you’re holding a variable-rate mortgage, this rate cut signals a decrease in interest expenses. For example, for anyone with a variable rate with adjustable payments, you will see payments drop roughly $14 per $100,000 of mortgage (depending on your rate, amortization, etc.)

HELOCs - Interest-only payments would drop almost $21 per $100,000 as well.

Fixed-Rate Mortgages - Unchanged for now, but fixed rates are mainly influenced by the bond market and its expectations of the overnight rate’s direction. As we enter a rate-cutting cycle, bond yields should trend lower from here… and so should fixed mortgage rates.

We from Unna Real Estate Group, believe that the relationship between interest rates and home prices is a critical dynamic in the real estate market. When borrowing costs were at their lowest, home prices skyrocketed due to increased demand. As the overnight lending rate began to climb, the rapid growth in home prices started to slow down, illustrating the direct impact of interest rate policies on the housing market.

It is important to know that if the Bank of Canada reduces interest rates in response to economic conditions, it could stimulate the housing market, potentially reversing the recent price declines. The response of buyers to lower interest rates will be crucial. If confidence in the market remains high and borrowing costs decrease, a resurgence in home prices is likely.

New Content: Lower Monthly Payment or Paying More Interest?

Introduction: sConsidering buying a home? Picking the right mortgage term is crucial. In Canada, the standard is a 25-year amortization, but 30-year terms are gaining popularity due to rising interest rates. Starting August 1, 2024, first-time home buyers can opt for 30-year terms for newly built home, Understand the new rules:

If you're not a first-time buyer, you can still get a 30-year mortgage with a 20% down payment or by choosing an uninsured mortgage. Unsure about term length? Think about whether you want lower monthly payments or are okay with paying more interest over time.

Advantages and Disadvantages of a 30-year Mortgage Term:

Pros: Lower monthly payments make homeownership more affordable, especially for younger buyers. Increased borrowing power.

Cons: Higher total interest payments over the mortgage's life.

Impact of the New Rule on the Canadian Housing Market:

This rule change could stimulate demand for newly built homes, potentially boosting construction activity. However, it may also artificially inflate prices if demand outpaces supply.

Eligibility Criteria for a 30-year Mortgage with Less than a 20% Down Payment:

Currently, a down payment higher than 20% is required for a 30-year mortgage. With the new rule, first-time homebuyers can choose this option even with less than 20% down, but it's limited to newly built homes.

Our Opinion: The government should extend this option to all homebuyers, regardless of property type. This would promote affordability and accessibility in the housing market.

"Click the link below to schedule a personalized 1:1 call with us and explore the best options for you. If you're considering purchasing new construction, sign up for our newsletter to stay updated on all projects in Toronto and the GTA."

In response to the challenges faced by young Canadians in saving for their first home, the government has proposed significant changes to the Home Buyers' Plan (HBP). These changes include increasing the withdrawal limit and extending the repayment grace period, aimed at easing the path to homeownership for first-time buyers.

Understand: Let's break it down:

The Problem: Young Canadians often struggle to save enough money for a down payment on a house and to qualify for a reasonable mortgage.

The Solution - Home Buyers' Plan (HBP): The government has a program called the Home Buyers' Plan (HBP) which lets you take money out of your retirement savings (RRSPs) to buy or build a home.

Current Limits: Right now, you can withdraw up to $35,000 from your RRSPs under the HBP to put towards buying a home.

Proposed Change: The government wants to make it easier for people to buy their first home. So, in the proposed Budget 2024, they suggest increasing the limit from $35,000 to $60,000. This means you could take out more money from your RRSPs to use towards buying your home.

Extended Repayment Grace Period: Also, if you've taken money out of your RRSPs under the HBP between January 1, 2022, and December 31, 2025, the government wants to give you more time to pay it back. Normally, you have to start paying back the money within two years, but with this proposal, they're extending that grace period to five years. This way, you have more time to focus on paying your mortgage and getting settled in your new home without the added pressure of repaying the RRSPs.

Is now the perfect time to sell your property? All signs point to a resounding YES!

Buyer interest is on the rise, but available properties are scarce. So, if your place is priced right, in a sought-after location, and visually appealing, get ready to face fierce competition.

As more sellers realize the demand from eager buyers, they’ll start listing their properties too, intensifying the competition. That’s why it’s vital to take every possible step to secure a swift sale and achieve the most favourable price.

1. Pricing: get the number right

Finding the right price can be a challenge, especially in the current market with various pricing strategies being used by agents. So, what’s the best approach for you?

Before making any decisions, it’s crucial to grasp the neighbourhood dynamics. If you notice other listings with low prices and offer dates, that should be your winning strategy too. On the flip side, if you price your home close to market value while others go low, potential buyers might think it’s out of their budget.

Conversely, if everyone in your area is pricing at market value, that should be your approach as well. And if it is a mix of both, trust your agent’s advice and follow their recommendation.

However, keep in mind that underpricing your home doesn’t guarantee a bidding war. You might end up receiving lower offers than expected or no offers at all.

And remember, be careful when pricing your home over market value. Some sellers assume buyers will negotiate a lower offer, but in reality, they usually won’t unless the property has been on the market for a significant period of time.

2. Presentation: dial up the appeal

Pay attention to every detail that needs fixing – Remember, buyers, will spot imperfections first, guaranteed.

Neglecting the small stuff might lead buyers to assume that major maintenance has been neglected too. Their offer will reflect this assumption or they might not make an offer at all. Take care of it all!

Create a lasting first impression – Did you know buyers have already made up 50% of their minds the moment they enter the door? Invest in creating an inviting entryway.

Make them think, “Wow, this place is bright and beautifully designed!”

Illuminate your space – No one wants to live in a dark home. So, brighten things up! Replace bulbs throughout the house so they match, and consider upgrading from basic fixtures to something more appealing.

Remember: an outstanding presentation is about appealing to buyers, not showcasing your personal taste. They should be able to envision themselves living there. Provide them with a bright, neutral, and relatively blank canvas that allows their imagination to soar.

3. Promotion: Spread the word like wildfire!

The more eyes on your listing, the better.

If it’s a condo, make sure the marketing showcases the unit and the building itself. People want to see the lobby, amenities, and location—anything that adds value to the overall package.

Photos play a crucial role, and a top-notch agent won’t settle for mediocre images taken on a phone. They will collaborate with a skilled photographer who knows how to capture the best shots, including the perfect timing. For instance, if you have a stunning view, photographing it at sunset will have a far greater impact than on a rainy afternoon.

Thinking about starting your journey in the real estate market? That is exciting, but it can also be a little scary. But becoming a homeowner is possible with solid strategies.

We selected a few tips that may help you in this next step:

1. Prepare yourself for encountering strong competition when it comes to desirable properties.

Due to low inventory levels, the options available for selection are limited. The number of buyers in the market has been relatively low until recently. However, as the spring season progresses, an increasing number of buyers are initiating their property search, leading to heightened competition.

2. Thoroughly research and gather information before making any decisions.

Sellers are employing various strategies, such as offering low prices and setting offer dates, but these tactics are not consistently used in all areas. The asking price alone may not accurately reflect the property’s value, making it challenging to find affordable options. It is common to come across homes listed at market value alongside properties priced lower to attract multiple offers. Determining the appropriate offer to make or even deciding whether to make an offer at all can be difficult.

3. Every neighbourhood is its own market.

You can’t generalize about the GTA – it’s way too big and diverse. In one area, offer dates may be the norm. In another, sellers may be listing at market rate.

4. If you love something, don’t wait.

Although there was a brief period when buyers had the luxury of taking their time and making conditional offers, the current market dynamics have changed. While certain areas of the city may still allow for some flexibility, highly desirable properties are being swiftly claimed. Therefore, if you come across a property that truly resonates with you, act promptly and submit an offer.

5. Avoid focusing on the attractive and eye-catching listings.

If you wish to avoid being outbid by buyers with greater financial resources, consider exploring properties that have not been effectively presented or marketed. While everyone is naturally drawn to homes with stunning decor and appealing lighting, staged properties often fetch higher prices compared to those that have not been aesthetically enhanced.

6. Consider exploring properties that have been on the market for an extended period.

After the initial 14 days, buyers tend to shift their focus to newly listed properties. However, there are various reasons why homes may not sell immediately. It could be a matter of incorrect pricing, inadequate presentation or marketing efforts, or the need for some renovations. Sellers whose listings have not garnered significant attention are often more open to negotiation.

7. Buy whatever you can afford, wherever you can afford it.

The limited inventory in the market has resulted in higher prices. So, how can an individual who is not financially affluent, particularly first-time buyers, actually afford to buy a property? The key is to start small.

Instead of searching for your forever home right from the start, consider buying a one-bedroom property in Hamilton or Dundas if you can gather enough funds. You don’t necessarily have to live there, you can rent it out to someone else and have their rental payments cover the mortgage, even if you continue living in a rental property yourself. By doing so, you will start building equity while waiting for the property’s value to appreciate.

If you are interested in purchasing a home, reach out to us today for additional tips and guidance.

We’re back at it again with a review of Market numbers for the month of April. Lets have a look at the numbers from the first month of Spring.

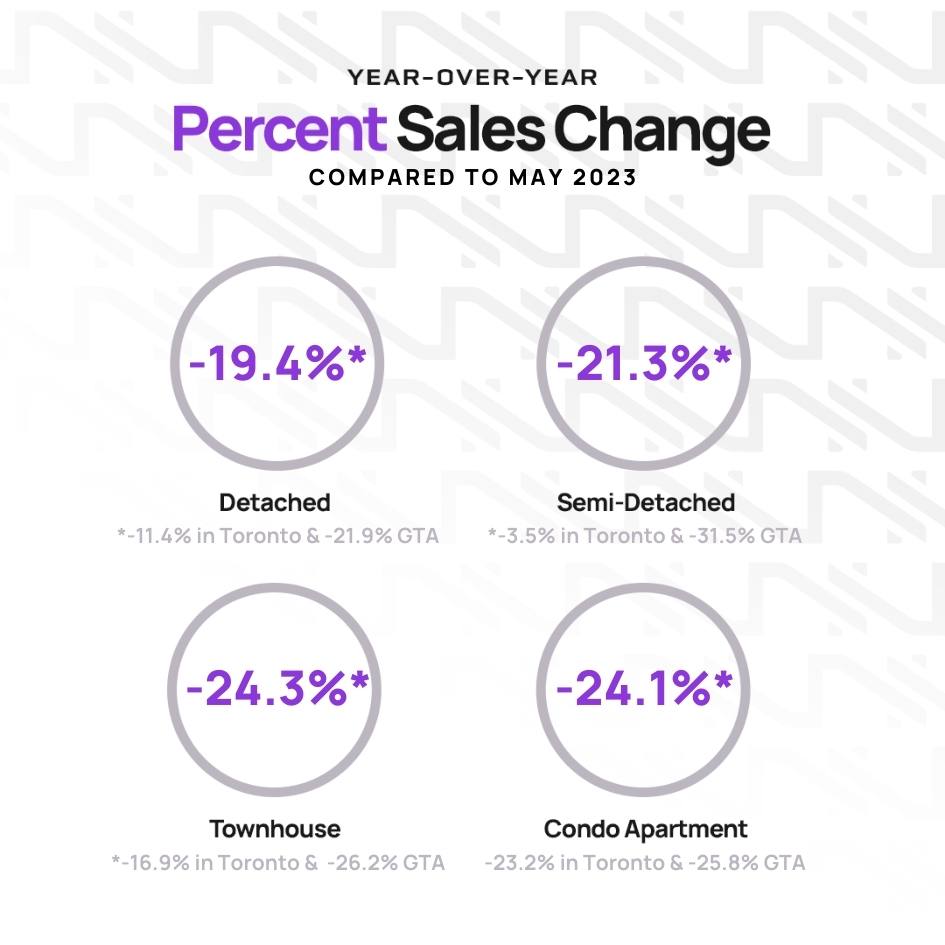

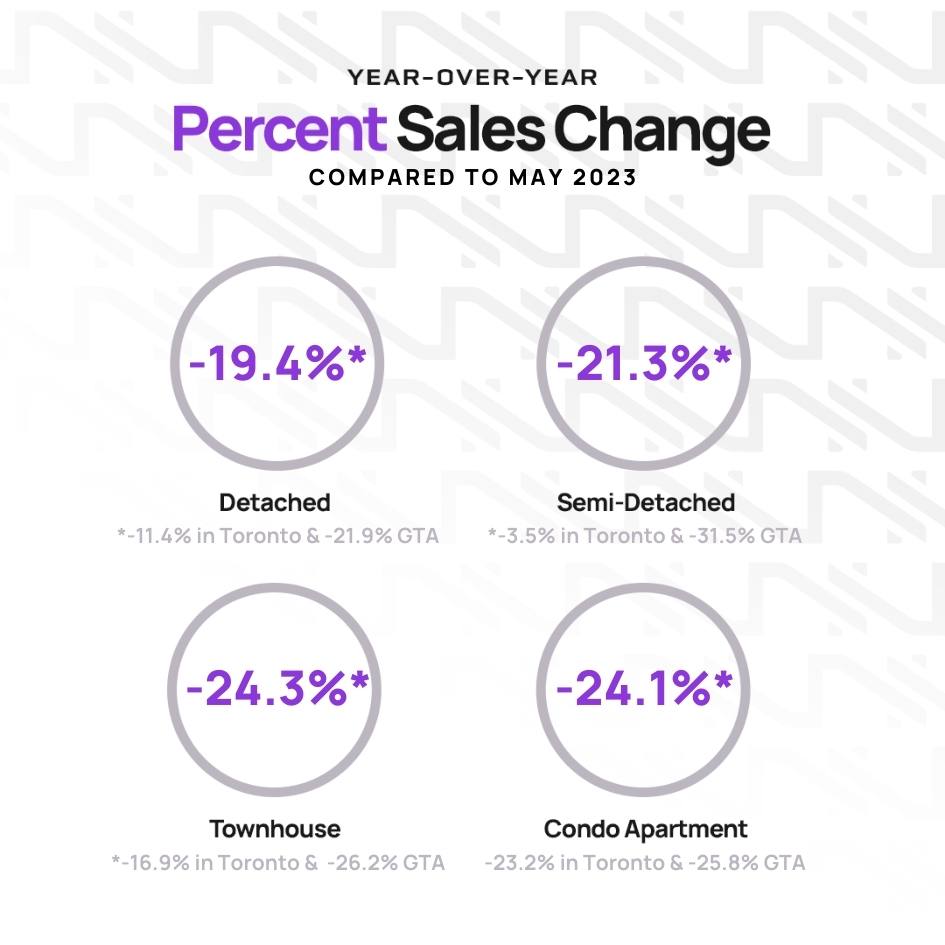

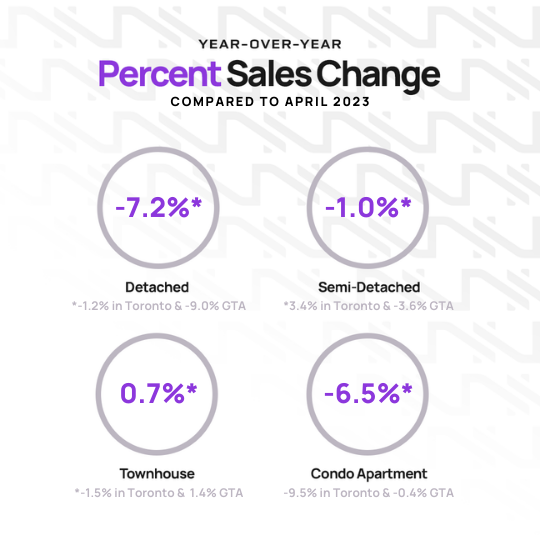

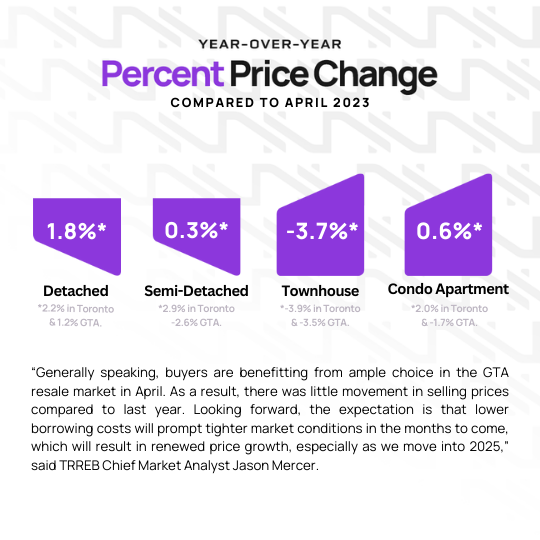

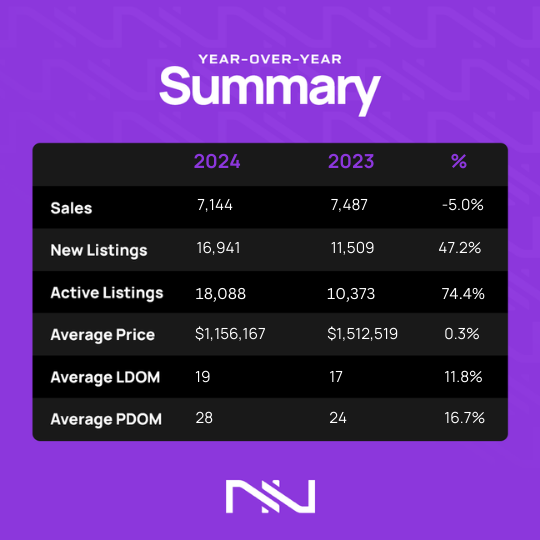

April 2024 home sales were down in comparison to April 2023, when there was a temporary resurgence in market activity. New listings were up strongly year-over-year, which meant there was increased choice for home buyers and little movement in the average selling price compared to last year.

Greater Toronto Area (GTA) REALTORS® reported 7,114 sales through the Toronto Regional Real Estate Board (TRREB) MLS® System in April 2024 – down by five per cent compared to April 2023. New listings were up by 47.2 per cent over the same period. On a seasonally adjusted monthly basis, sales edged lower while new listings were up compared to March. Listings were up markedly in April in comparison to last year and last month. Many homeowners are anticipating an increase in demand for ownership housing as we move through the spring.

While sales are expected to pick up, many would-be home buyers are likely waiting for the Bank of Canada to actually begin cutting its policy rate before purchasing a home,” said TRREB President Jennifer Pearce.

Consistent Flooring

If your home features various types of flooring, consider creating a more cohesive look by sticking to one or two types. This can make your home more appealing to potential buyers. While not all carpet needs to be replaced, consider removing any outdated or stained carpets for a fresher appearance.

Brighten Up the Kitchen

White kitchens are a timeless favourite among buyers. To enhance the appeal of your kitchen, opt for a clean and illuminated white colour scheme. Upgrading cabinets or giving them a fresh coat of paint can also elevate the overall look.

Upgrade Countertops

Outdated countertops can deter buyers. Consider upgrading to materials like granite, marble, or white or gray quartz for a modern touch. If you choose to replace the countertops, ensure that the rest of the kitchen is cohesive to avoid mismatched aesthetics.

Fresh Paint

Before listing your home, painting the interiors is recommended by over half of Real Estate Professionals. Popular choices include Sherwin-Williams Agreeable Gray and Benjamin Moore’s Revere Pewter for a neutral and inviting appeal.

Deep Cleaning

Thoroughly cleaning your entire home can significantly enhance its appeal to potential buyers. Focus on decluttering, deep cleaning bathrooms and kitchens, and paying attention to details like grout lines and mould spots. Consider hiring a professional cleaner for a more thorough job.

Feng Shui: Front Door

Feng Shui: Hallway

Feng Shui: Kitchen

Feng Shui: Living Room

Feng Shui: Dining Room

Feng Shui: Bathroom

Feng Shui: Garden